Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

Mortgage as a weapon: Save and gain millions extra

Recently, I’ve been meeting with many clients whose record-low mortgages from 2020–2022 are now reaching the end of their first fixed period. They often face the same question: Should I repay part of my mortgage early, or is it better to invest the money instead?

Interest rates around 2% have been replaced by 4–5%, resulting in higher monthly payments. Yet even in this situation, early repayment isn’t always the smartest choice.

From experience, I know that the desire to be debt-free is strong. For some people, the psychological relief of paying off debt is invaluable — they simply sleep better.

But a mortgage is a unique kind of debt: it’s one of the cheapest loans available, and when managed wisely, it can be a powerful tool for building wealth. As investment analysts point out, even with mortgage rates of 4–5%, a well-diversified long-term investment portfolio can earn 7–9% per year. And that difference is the key.

Why you should invest instead of repaying early

1. Investments outperform mortgage interest over time

Simply put — if your money earns more than what you pay to the bank, you’re winning. We’ve applied this principle many times in practice. Clients who chose to invest regularly instead of making lump-sum repayments achieved a higher net worth after 15 years.

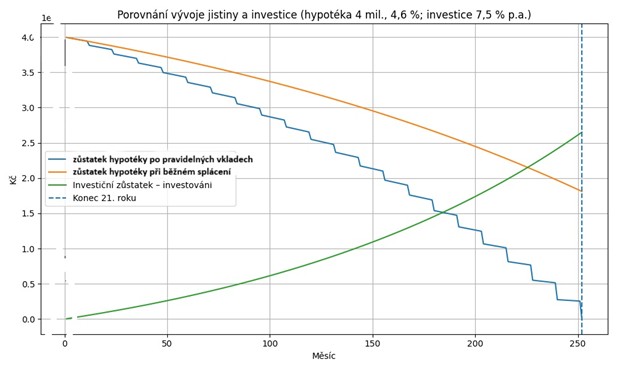

Example:

A mortgage of CZK 4 million at 4.6% p.a. for 30 years results in a monthly payment of about CZK 20,506. This family had CZK 4,494 left per month to invest.

Option 1: Make extra repayments and finish the loan in 21 years — but with no savings left over.

Option 2: Invest the same amount at an annual return of 7.5% (typical for an equity portfolio). In that case, they could repay the mortgage in 20 years — and after 21 years, have an additional CZK 840,000 in assets.

This time and yield difference clearly shows that investing instead of early repayment leads to greater long-term wealth.

2. The power of compound interest

When you keep your money invested over time, it earns returns not only on the principal but also on past gains. That’s the magic of compounding.

Even modest, regular monthly investments can grow significantly — if you give them time. Investment rules are clear: “time is the most powerful factor in investing.”

For instance, investing CZK 2,000 a month for 20 years at 7.5% p.a. results in CZK 1,107,461 at the end.

3. Tax benefits

Mortgage interest can be deducted from your taxable income. For example, with a mortgage rate of 4% and an income tax rate of 15%, the effective interest rate drops to about 3.4% after tax savings.

In other words, the state helps finance your housing — and it would be a shame to give up that benefit.

By repaying early, you actually lose a tax advantage, effectively increasing your total tax burden compared to continuing with standard payments.

4. Inflation works in your favor

Inflation reduces the real value of debt. Every year, you’re repaying in “cheaper korunas.” If inflation is 3% and your mortgage rate is 4%, the real cost of the loan is just around 1%. Economic models show clearly that inflation tends to help borrowers preserve wealth — meaning your mortgage effectively becomes cheaper over time.

5. Liquidity and flexibility

When you use a large portion of your savings to make a lump-sum repayment, you reduce your debt but also lose liquidity — your money gets locked into the property.

That’s why I advise clients to keep a liquid financial cushion and invest the rest in a diversified portfolio, which can also be accessed if needed. This approach is favored by most experts — both investment and mortgage specialists.

A real example from our practice

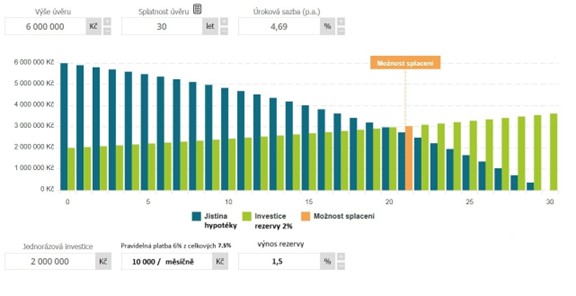

A client with a CZK 6 million mortgage at 4.69% for 30 years wanted to make a CZK 2 million lump-sum payment to reduce the balance to CZK 4 million and lower monthly payments by about CZK 10,000.

Instead, we invested the CZK 2 million at an average long-term return of 7.5% p.a., dividing the yield into two parts: 6% + 1.5%.

The 6% yield (CZK 120,000 per year, or CZK 10,000 per month) covered the payment reduction, so the client effectively paid the same amount as if the mortgage had been reduced.

The remaining 1.5% yield was left to grow as a long-term reserve — which after 30 years accumulated approximately CZK 3,126,160.

If the same CZK 2 million had been used for repayment, the money would have been “locked into the property”, generating no growth.

|

Scenario |

Description |

Monthly payment |

Balance after 30 years |

|

Original mortgage |

CZK 6 M, 4.69%, 30 years |

CZK 31,100 |

CZK 0 |

|

Lump-sum repayment |

CZK 4 M, 4.69%, 30 years |

CZK 20,700 |

CZK 0 |

|

Investment strategy |

CZK 6 M, 4.69%, 30 years, invest CZK 2 M at 7.5% p.a. |

CZK 31,100 – 10,000 = CZK 21,100 |

CZK 3,126,160 |

In both cases, the family’s monthly budget remains similar — but the investment strategy keeps the money liquid and growing. After 30 years, total wealth is millions higher.

Conclusion: Let your mortgage work for you

Becoming debt-free sounds appealing, but from an economic perspective, it’s not always the smartest move.

A mortgage with a relatively low interest rate can be a powerful financial tool, especially when combined with long-term investing instead of early repayment.

As I often tell my clients:

“The goal isn’t to be debt-free — it’s to have the freedom that comes from assets growing faster than your debt.”

We’ll be happy to meet and find a personal strategy that helps your money grow effectively.

Stone & belter blog

Similar articles

Category