Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

Understanding the Mortgage Process for Foreigners in the Czech Republic – Part 2

If you’ve already read Part 1, you know that securing a mortgage in the Czech Republic as a foreigner is entirely possible – especially with the right information and preparation. In this follow-up, we’ll walk you through the step-by-step application process, and explain why working with a local financial advisor can save you time, money, and a lot of stress.

Prefer reading this in Czech? Click here for the Czech version.

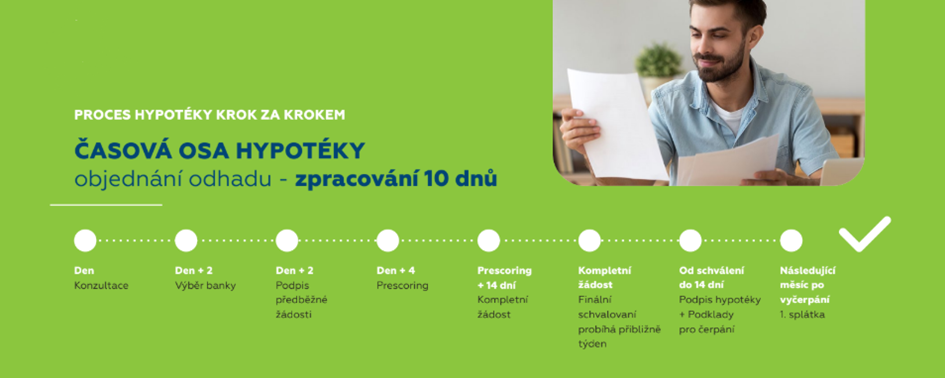

The application process for a mortgage as a foreigner is relatively straightforward:

1.Choose a Bank: You’ll need to research and choose a bank that offers mortgages to foreigners. Popular banks for foreigners include Česká spořitelna, Komerční banka, and UniCredit Bank, but there are many other options to explore.

2.Prepare Documentation: Gather all required documents, including proof of income, bank statements, employment contracts, and identification documents (passport, visa, etc.).

3.Submit the Application: Complete the mortgage application form and submit your documents to the bank. The bank will assess your financial situation, creditworthiness, and the property’s value.

4.Property Valuation: If approved, the bank will arrange for a property valuation.

5.Mortgage Offer: Once everything is approved, the bank will make a formal mortgage offer, outlining the terms of the loan (interest rate, repayment period, monthly payments, etc.).

6.Signing the Contract: After reviewing the mortgage offer, you’ll sign the loan agreement, and the mortgage process will be completed.

7.Withdrawing the Mortgage: Last a more or less complicated step when submitting additional documents like signed purchase contract, pledge contract, property insurance etc. are necessary.

Work with a Financial Advisor

While the mortgage process in the Czech Republic can seem straightforward, it can be complicated by language barriers, differences in banking systems, and unfamiliar documentation requirements. For this reason, it’s highly recommended that you work with a financial advisor or mortgage broker who is familiar with the local market and can guide you through the entire process.

A financial advisor can help you:

-Choose the right bank that best suits your needs.

-Navigate the different types of mortgage products available.

-Ensure that your documentation is in order and submitted correctly.

-Avoid potential pitfalls, such as issues with the Czech Central Bank registry.

-Provide valuable insights into the Czech property market.

The best part is that these services typically come at no additional cost to you, as they are often compensated by the bank or financial institution. By working with an advisor, you can make the entire mortgage application process much smoother, saving you time and stress.

If you’re considering buying property in the Czech Republic but aren’t sure where to start, feel free to reach out to our team. We’re here to help you navigate the mortgage process with ease.

Stone & belter blog

Similar articles

Category