Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

Insurance as a Penalty II

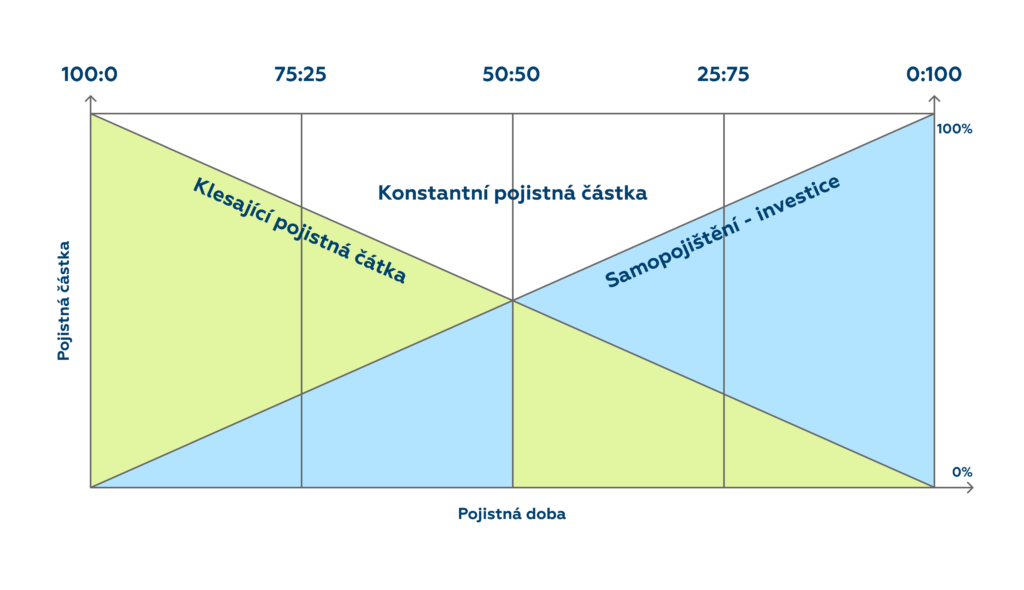

The costs of treating a serious illness (such as spa stays beyond public health insurance coverage, assistive devices, etc.) are practically the same regardless of age. Therefore, for this type of insurance, we should set a constant insured amount – of course, for an adequate premium. However, if I have assets that I can liquidate in case of urgent need (an investment apartment, a substantial amount in investments, etc.), I don’t necessarily need to take out this insurance and can save on the premium.

There is also the option that, although you do not currently have such assets, you have sufficient income to build them up yourself as part of self-insurance.

The process is as follows: Critical illness insurance can be arranged with a gradually decreasing insured amount. At the same time, it is necessary to invest regularly so that the gradually increasing investment balance offsets the decreasing insured amount – until one day it covers the entire insurance risk.

This solution is cheaper in terms of premiums paid, and if we avoid this risk in life, the entire invested amount (unlike with traditional insurance) will remain available to us.

The basis of financial responsibility is to be well secured.

From both examples – today’s and the one from the first part – it is clear that the foundation of financial responsibility is to be well protected, whether through liquid assets or insurance. And for “less wealthy” clients, insurance can seem like a “penalty” for not having assets to sell, or for having “eaten through” them after restitution or inheritance.

Let’s Summarize:

- We insure ourselves against potential risks.

- Protection can be provided by:

- Own assets – self-insurance

- Insurance through an insurance company

If we are self-insured – acting as our own insurance company:

- We are not insured by an insurer

- We don’t pay premiums

- We invest the saved money

- In the event of a claim, we cover the damage ourselves

Assets Suitable for Self-Insurance:

- Financial

- Real estate

- rental income

- sale

When Insurance Is Necessary

Insurance against, for example, critical illnesses or loss of income due to incapacity for work is necessary if you do not have sufficient savings or assets to cover the loss of income in the event of an unexpected event.

Property insurance depends on the value of the items you own. If you don’t have particularly valuable property, it might be unnecessary for you. However, underestimating potential consequences can cause irreparable damage.

Insurance is a tool for protection against risks that could have a long-term negative impact on your finances. But when you have enough liquid assets, insurance to protect against smaller losses from an unfortunate event is not strictly necessary – such losses can be covered by partially selling assets.

In any case, none of this should be taken as a general recommendation suitable for everyone. It is always advisable to consult everything with a professional when assessing your personal and financial situation. Contact us, and together we will find a solution that meets your needs and possibilities.

Stone & belter blog

Similar articles

Category