Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

Children’s Savings Insurance Policies: Yes or No?

Everyone has one. “You wouldn’t leave a child uninsured, would you? I’ll pay for it if the young ones don’t care; I love my grandchildren. I’m being responsible, and I’ll save something for the kids!”

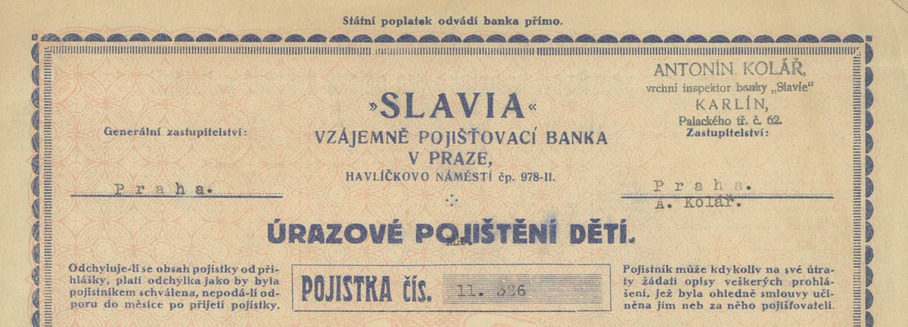

Sluníčko, Flexi, or Combined Insurance for Children and Youth from the time of Czechoslovakia are among the most well-known children’s insurance products.

Before 1989, almost every child had life insurance. Mothers often met insurance agents already in the maternity ward, and together with the baby, they took home an insurance policy. At one time, insurance for children and youth was the second most common type of policy in Czechoslovakia!

After eighteen years of saving (paying premiums), the new adult received the policy from their parents. Often, it was accompanied by a small family ceremony, ending with the words: “Now you take care of it.”

This continued even after the Velvet Revolution. Everyone was happy – parents and insurance companies alike.

The returns on the “savings” part of the policy were decent, even excellent. The guaranteed return was 6% (technical interest rate). And thrifty Czechs weren’t foolish enough not to take advantage of it. Why wouldn’t they, when upon maturity they received all their money back and were effectively insured for free?

Things started to falter in 2002, when the guaranteed return dropped to 4%, and again in January 2004, when it fell to 2.4% annually.

At that point, the advantages of saving for children through life insurance became questionable. (Even though insurance marketing tried to promote it aggressively.) After all, it’s still insurance, and insurance costs money – often more than people imagined!

To start with, you immediately lose the equivalent of two years of your contributions. So that 1,000 CZK (≈ 40 EUR) per month instantly turned into a loss of 24,000 CZK (≈ 960 EUR) upon signing. And don’t forget the insurance fees – they still had to be paid. With a return of only 2.4% annually, recovering the 24,000 CZK (≈ 960 EUR) loss was nearly impossible.

Insurance companies also made sure that not too many contracts with a guaranteed 6% return remained among clients.

These were the famous visits from representatives with “important updates about your contract”, after which you ended up with new “better and modern” contracts (often with new entry fees).

What followed was the era of complaints: “Sluníčko is a joke,” “Never again! After two years of saving, we have nothing, no thanks,” “It’s wasted money,” “Don’t expect attractive returns” (source cited below). And this sentiment persists to this day. Moreover, since 2013, it has been prohibited to market life insurance as a savings product!

Source: Muzeum pojištění

Children’s Savings Insurance Policies: Yes or No?

For decades, they were popular, and parents considered them a basic step in securing their children’s financial future. But times have changed. Guaranteed returns have dropped to minimal levels, while policy costs have increased.

So is it really wise to invest money into children’s savings insurance policies?

Advisors from Stone&belter offer a comprehensive analysis and will help you find the best solution for your children’s future. Call us or contact your advisor to get the information you need. Investing in a properly structured investment portfolio can be a more effective and less costly alternative to traditional children’s savings policies.

Let your money grow and ensure a stable financial foundation for your children.

And by the way, have you read our latest article on the pros and cons of saving for children through building savings? If not, you can explore it [HERE].

Sources:

Discussions on měšec.cz, peníze.cz, idnes.cz (2005 and 2006)

Note: All amounts in CZK were converted to EUR at a fixed exchange rate of 25 CZK = 1 EUR.

Stone & belter blog

Similar articles

Category