Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

What’s Next for Bond Funds?

Over the past two years, there has been increasing talk about the long-forgotten investment potential of bond funds, which had been in an investment coma for a decade. Shortly after the Czech National Bank (CNB) sharply raised interest rates, their performance was so poor that only an investment daredevil – or a responsible client with their investment advisor – would invest in them.

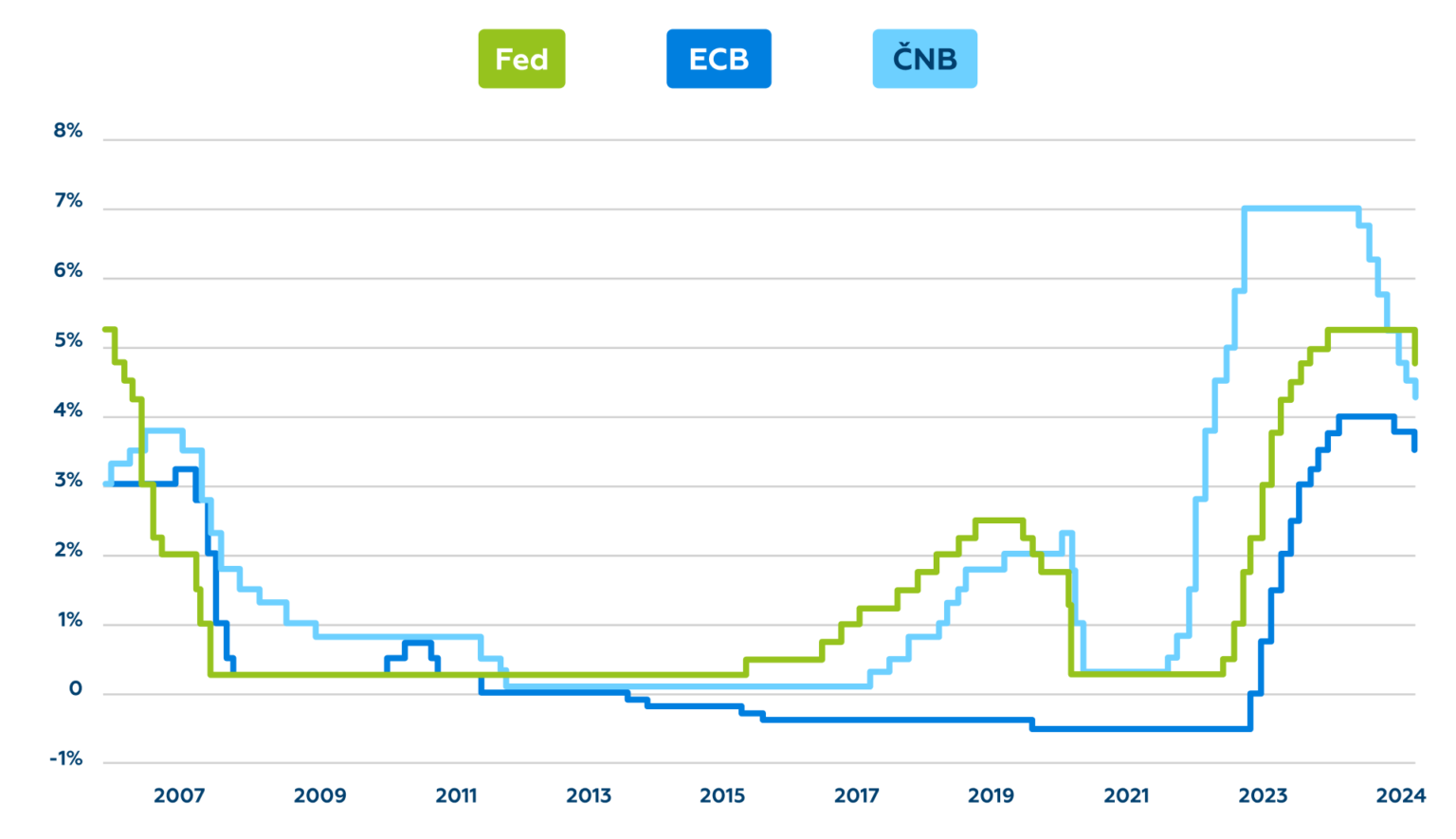

In its effort to curb inflation, the CNB fired a real 7% “big gun,” leaving the U.S. Federal Reserve (Fed) and the European Central Bank (ECB) far behind. This also brought with it yield potential for the coming years, triggered at the start of rate cuts. Throughout the year, everyone was just waiting for the “when.” That moment came at the end of 2023, and because markets are typically “forward-looking” – meaning that most of the effects of rate cuts, i.e., the growth in bond fund performance, are already reflected in asset prices at the moment of the first cut – the almost risk-free performance of bond funds in 2023 was around 7% p.a., with lucky timing even hitting double-digit returns, which after years of misery felt like a dream.

This year has been marked by the gradual lowering of CNB rates to the current 4.25%. After last year’s yield feast, the current 7% performance may seem low to some. While there is still nearly a full quarter left in the calendar year, let’s discuss the cause of this “breather,” particularly evident in the first half of the year.

The Fed. Always look for the U.S. central bank. The CNB set its rates attractively high, making especially short-term government bonds very appealing to foreign investors. But as we can see from the chart, the CNB’s gradual rate cuts have brought it below the Fed’s level. Inflation may be under control, but the CNB has also shot itself in the foot a bit. The appeal and safety of U.S. Treasuries compared to Czech ones is a whole different ball game. We can disagree with it, we can protest, but that’s about all we can do.

If the CNB were to continue cutting rates so aggressively, it would mean increased outflow of foreign investors and reduced interest in the Czech koruna. While exporters would welcome its weakening, it would also mean higher prices for all imports, such as oil. This would raise fuel prices and everything dependent on them, and so on. In short, it would reignite inflation. That, in turn, would mean interest rates would have to go back up, leading to a drop in bond prices.

The CNB’s situation is not trivial. Slowing the rate-cutting cycle is inevitable, and even a temporary pause cannot be ruled out. Although the inflation outlook is promising, it makes sense to proceed as cautiously as possible in setting monetary policy. Whether they like it or not, central bankers must accept that the Fed’s hawkish “pivot” changes the overall interest rate calculation. Not only the CNB, but others too, will have to at least partially align their monetary moves with the Fed.

Central Bank Rates

Kay interest rates of the US Fed, ECB and CNB

Source: Bloomberg, Cyrus

How to react to these changes?

Investors should especially remain calm and stick to their long-term strategy. The key to success is a long-term plan and the right investment strategy – whatever it may be – and not trying to be smarter than the market. Simply wait for your return and ride it out. There’s still ammo in the tank.

Remember, investing is actually simple. Most of the time, all you need is time, patience, and the right partner. If you’re interested in a consultation, get in touch.

Stone & belter blog

Similar articles

Category