Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

Bitcoin: Fill in the Gaps – We’re Going to Talk About It!

In December 2024, Bitcoin crossed the $100,000 mark and once again sparked heated debate. Is this another tulip mania?

Few assets can divide public opinion like Bitcoin. In this article, I’ll try to explain what Bitcoin actually is.

Bitcoin was created in 2009 in response to the ongoing global financial crisis. It was not developed by governments or central banks, but by a group of creators and critics of the traditional centralized financial system. One of the key arguments for its creation was so-called monetary inflation.

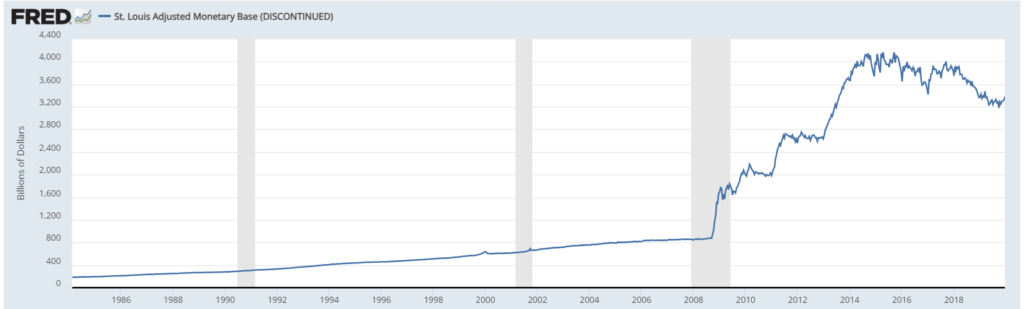

The creators of Bitcoin were alarmed when, during the 2008 financial crisis, the U.S. central bank “printed” large amounts of U.S. dollars to stimulate the economy, causing its value to decline. The chart below shows the turning point known as quantitative easing – essentially, the printing of dollars.

Source: Federal Reserve Bank, https://fred.stlouisfed.org/series/BASE

Unlike all the currencies of the developed world, the total number of Bitcoin units is fixed at 21 million.

Technically, it is impossible for there to ever be more. This is because Bitcoin has a built-in mechanism in its protocol that limits its total supply to the aforementioned 21 million units. This limit is a key feature of Bitcoin, implemented through mathematical rules in its source code.

This number will be reached gradually by reducing mining rewards (known as halving), which occurs approximately every four years.

With each Bitcoin halving, the reward for mining one block is cut in half.

This slows down the release of Bitcoins into circulation until around the year 2140, when the final Bitcoins will be mined to reach the total of 21 million. Thanks to this limit, Bitcoin is a deflationary currency, which sets it apart from traditional “fiat” currencies. (In Latin, fiat means “let it be,” and in this context, it means a currency has value simply because a government or other authority declares it legal tender.)

This makes Bitcoin an interesting store of value.

Recently, it has been compared to gold – not only with a number of advantages, but also with greater price volatility and faster value growth.

Bitcoin was the first cryptocurrency and can be described as a form of global, non-governmental money.

Today, there are about twenty thousand cryptocurrencies. New ones are constantly being created – some purely for the quick enrichment of their creators (sometimes fraudulently), and some lose their value entirely. This strengthens Bitcoin’s position as the primary tradable cryptocurrency.

What Could the Future Hold for Bitcoin?

And why do we think it’s worth accepting and considering in a portfolio? While Bitcoin faces challenges and competition from newer cryptocurrencies, its history and performance so far suggest it may remain a key element in investment portfolios.

With growing interest from institutional investors and the approval of exchange-traded funds (ETFs), Bitcoin appears to be an attractive investment that can offer not only protection against inflation but also potential for growth.

Given these factors, it’s important to monitor Bitcoin’s development in the coming years and consider including it in investment strategies.

Regardless of whether Bitcoin becomes the new gold or faces further turbulence, its influence on financial markets and investment behavior is undeniable.

The newly elected U.S. president, Donald Trump, has told the media that Bitcoin will be part of the U.S. reserves (source: Forbes, 14 Dec 2024). If that happens, Bitcoin’s value could rise to even higher levels than today. We’ll just have to wait and see.

Bitcoin Is a Highly Volatile Asset

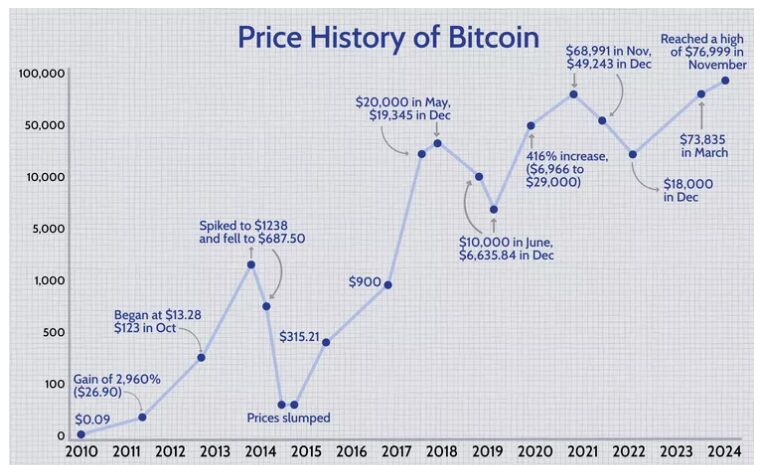

In an investment portfolio, for a bold investor who is not truly experienced in Bitcoin trading, it’s advisable to keep exposure at a maximum of 5% of the portfolio’s value. For context, see Bitcoin’s volatility from 2010 to November 2024 in the chart below.

Source: Investopedia, https://www.investopedia.com/articles/forex/121815/bitcoins-price-history.asp

Bitcoin: Potential and Pitfall

Bitcoin has a fascinating history and tremendous investment potential, but it’s not a holy grail. Just as quickly as it can rise, it can fall. Its volatility can be an opportunity for experienced investors but often ends in a nightmare for the unprepared.

Before deciding to invest, consider all the risks – from price fluctuations to possible regulatory interventions and even technological threats. Your investment advisor can guide you through all of these.

Stone & belter blog

Similar articles

Category