Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

What Are the Real Benefits of Loan Consolidation?

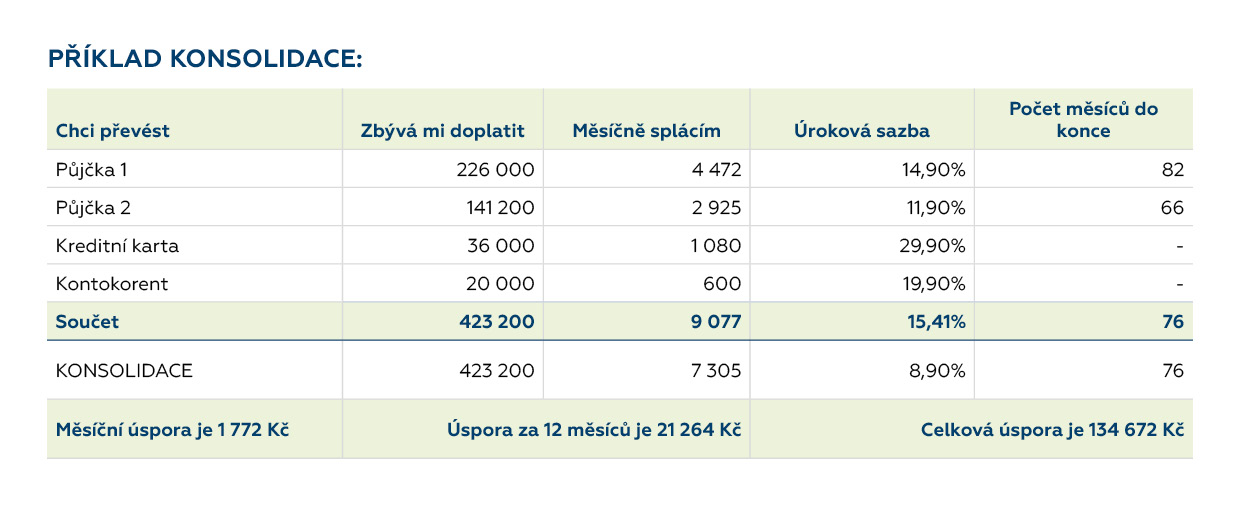

Are you struggling with several loans and feeling overwhelmed by multiple due dates? Do you find it hard to keep up with credit card and overdraft limits? Loan consolidation can help you solve this situation calmly and without stress. It allows you to combine all your loans and debts into a single monthly payment.

This gives you more control over timely repayments and often saves you money each month. One bank means one set of conditions! Use this tool to simplify your repayment schedule and ease the pressure on your household budget.

When Should You Consider Loan Consolidation?

Consolidation is not only for those juggling multiple debts. You should also think about refinancing if:

-

You have an unfavorable interest rate on your current loan.

-

You are paying excessive fees.

-

You need to extend your repayment period, which may be crucial after financial shocks such as the Covid crisis or during high inflation.

⚠️ Important: To be eligible, you need to be a reliable borrower – meaning no overdue payments on your current loans.

Main Advantages of Consolidation

-

One monthly payment instead of many.

-

Flexibility – you can adjust loan parameters, such as repayment term, conditions for extra payments, or due date.

-

Option to borrow extra money for urgent expenses.

-

Better interest rates in many cases, and elimination of unnecessary fees.

-

Clearer financial overview – one contract, one bank, less paperwork, and lower stress.

Disadvantages to Watch Out For

-

A lower monthly payment may sound good, but it often comes at the cost of a much longer repayment period and higher overall interest.

-

Consolidation is not automatically beneficial – always do the math before signing.

-

Never sign under pressure or without fully understanding the conditions.

Conditions for Loan Consolidation

-

Clean repayment history – no overdue debts or negative credit record.

-

Not all loans are eligible – for example, leasing contracts, microloans, or loans from some non-bank providers may not be consolidated.

-

Each bank has its own rules, so it’s important to check carefully.

How to Arrange Consolidation

There are two main ways to apply:

-

In person at a branch – ideal for those who prefer direct contact with a banker.

-

Online or by phone – many banks now offer digital applications.

If you are unsure which offer suits you best, it’s wise to consult a financial advisor.

Banks often reject consolidation applications without clearly explaining why. Experienced external advisors know how credit registries and internal approval processes work. With their help, your chances of approval increase, and you are more likely to secure the best conditions available.

On the other hand, if you apply on your own and your application is rejected several times, even an advisor might not be able to fix it right away, and you’ll need to postpone consolidation.

✅ Tip: In the Czech Republic, consolidation loans are common, but conditions vary widely between banks. In international contexts, the term debt consolidation loan is used – the concept is similar, but eligibility and benefits differ by country.

Stone & belter blog

Similar articles

Category