Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

How Does the Czech National Bank (ČNB) Influence Mortgage Rates? Why Is a 5-Year Fix Better than a 3-Year Fix?

The Czech National Bank (ČNB) influences mortgage interest rates through its monetary policy and decisions on key interest rates. Mortgage interest rates are partly affected by the overall interest rate in the economy as well as supply and demand in the mortgage market.

ČNB can influence mortgage interest rates in the following ways:

-

Repo rate – ČNB sets the repo rate, which is the interest rate at which it provides loans to banks. It is one of the key monetary policy tools that influence interest rates across the economy, including mortgage rates.

-

Macroeconomic policy – ČNB monitors the development of the economy and may adjust the repo rate and other policies in line with its inflation targets. Changes in the repo rate can affect mortgage rates, as banks often pass these changes on to their lending products.

-

Regulatory measures – ČNB sets regulatory rules that affect mortgage conditions. Currently, the most limiting are:

a) LTV (Loan-to-Value) – for clients under 36 years old, the maximum is 90%; for clients over 36 years old, it is 80%.

b) DSTI (Debt Service-to-Income ratio) – the ratio of a borrower’s total loan repayments to their net income. Currently max. 45% (for clients under 36 years old max. 50%).

It is important to note that ČNB influences the overall interest rate environment, but it has no direct control over specific mortgage rates. These are also shaped by other factors such as competition among banks, the riskiness of the mortgage market, and the overall state of the economy.

For the past 20 years, the rule of thumb was:

-

the lowest rate was the ČNB repo rate,

-

above this level came the so-called cost of funds (IRS),

-

and mortgage rates were typically 1–2% above the cost of funds.

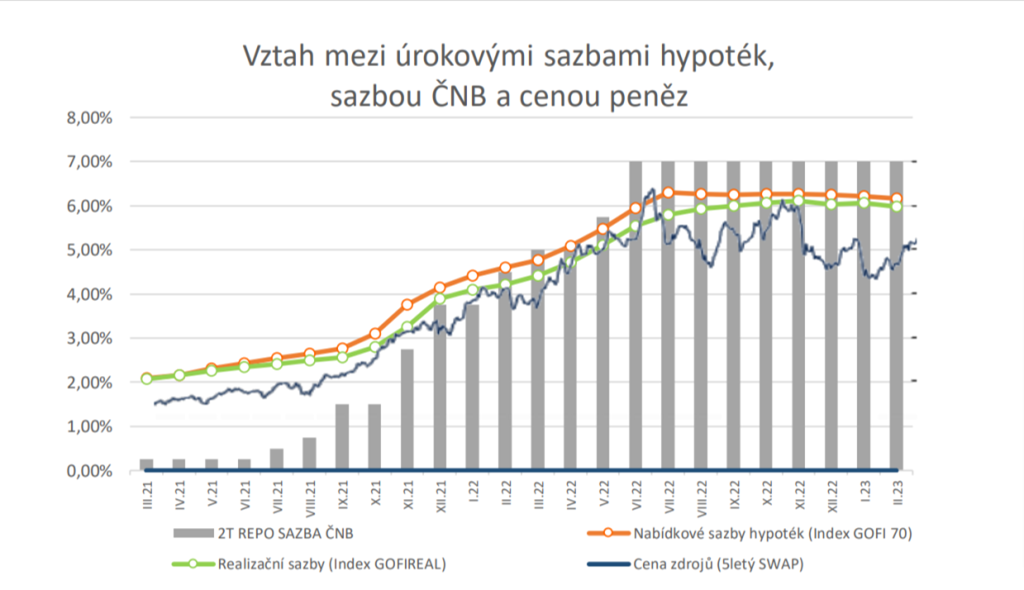

This paradigm, familiar to us over the last 20 years, stopped working roughly a year ago. The chart below illustrates this: ČNB’s rate has been at 7.0% for almost a year, while the cost of funds fluctuates between 4.50% and 5.50%.

And where are mortgage rates?

Source: Golem finance

Mortgage rates during this period have stayed around 6.0%, with the lowest offers currently at about 5.49% p.a. for a 5-year fixation. 3-year fixations are about 0.5% more expensive.

The market expects interest rates to decline in the future. So the key question is:

Should I choose a shorter 3-year fixation to refinance at a lower rate later, or should I lock in a 5-year fixation now?

Why a 5-Year Fixation Makes More Sense

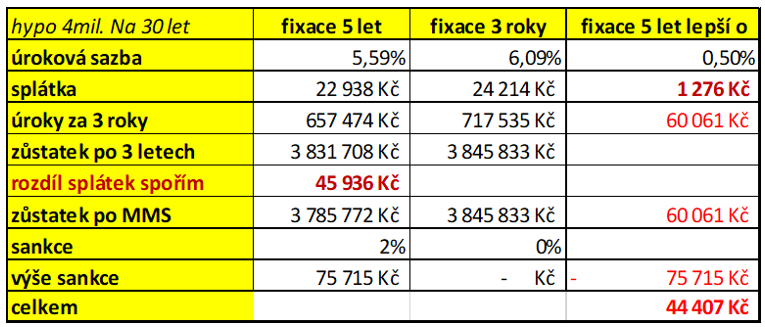

The table with calculations shows that a 5-year fixation is better due to the lower rate. A lower rate means lower interest costs and faster principal repayment.

For the 3-year scenario, we consider refinancing after 3 years, including the future early repayment penalty (2%), as proposed in the draft amendment to the law. Even with this penalty, the 5-year fixation is more advantageous.

In our calculation, we assume equal monthly expenses (the difference in payments is saved).

Model example:

-

Mortgage: 4,000,000 CZK (≈ 160,000 EUR)

-

Term: 30 years

-

Result: The 5-year fixation saves more than 44,000 CZK (≈ 1,760 EUR) compared to the 3-year fixation.

Source: Stone & Belter

Other Factors Favoring a 5-Year Fix

-

Will the law truly be retroactive? Or will the 2% penalty apply only to new mortgages?

-

Will the penalty really be 2%, or will banks charge less?

-

Banks now value client retention more than in the past, so there’s more effort to keep customers.

-

If rates fall faster within 36 months, refinancing might be worthwhile even with a 3-year fixation – but the 2% penalty would still apply.

-

With higher extra repayments every 12 months, the remaining balance (and thus the penalty) would be lower.

For completeness, we also calculated a scenario where the difference in monthly payments is not saved. In that case, the 3-year and 5-year fixation comparison is almost tied – with the 3-year option being cheaper by only 2,448 CZK (≈ 98 EUR) over 3 years.

Conclusion

Buying a property requires a comprehensive financial solution. Choosing the right fixation is only one of many aspects we help clients navigate when arranging a mortgage.

Of course, by comparing the entire market, we will ensure you get the lowest possible interest rate.

Note: All amounts in CZK were converted to EUR at a fixed exchange rate of 25 CZK = 1 EUR.

Stone & belter blog

Similar articles

Category