Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

Watch Out for the State Contribution of 4,080 CZK (€163.20) in Pension Savings from 1 July 2024

If you want to maximize the state support in your pension savings, it’s high time to adjust your monthly payment with your advisor. If you haven’t managed to do so yet, don’t worry – your advisor will help you adjust the monthly contribution and claim the contributions retroactively within the calendar year.

What changes in “pension savings” can we expect this year?

This year brings two major changes to both Supplementary Pension Savings – “newer contracts” (concluded after 2013), and Pension Insurance – “older contracts” concluded before 2013.

First, let’s look at the changes starting in July, and then those already in effect from January.

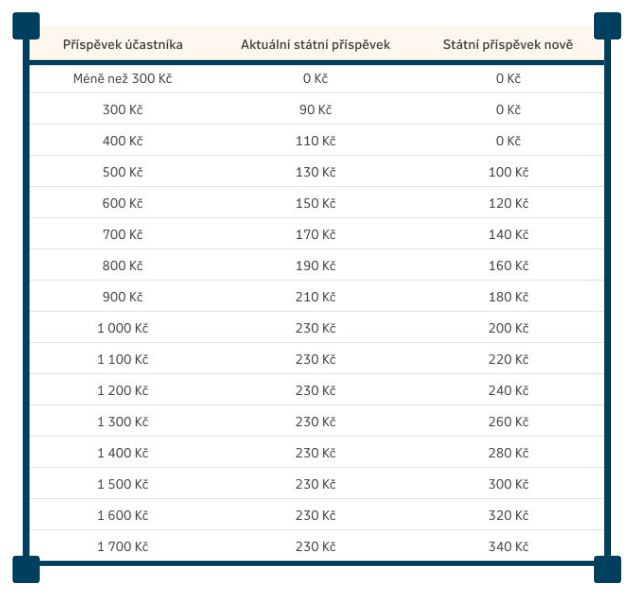

The state contribution increases from 1 July 2024

-

The minimum state contribution is obtained if you pay 500 CZK (€20) monthly.

-

The state contribution will always be 20% of your contribution.

-

The maximum state contribution is 340 CZK (€13.60) compared to the current 230 CZK (€9.20). The condition is that you save 1,700 CZK (€68) monthly.

-

You will not be entitled to the state contribution if you have been granted an old-age pension.

Zdroj: NN

Changing the contribution in “pension savings” is the ideal time to review whether your chosen type of contract is still suitable and, for new contracts, to assess the investment strategy.

“Old” Pension Insurance = Transformed Fund (TF): This is the original pension scheme that could be concluded until the end of 2012. The biggest advantage is the so-called service pension after 15 years of saving (the possibility to withdraw half of the saved funds).

“New” Pension Savings = Supplementary Pension Savings (DPS): Available since 2013. There is no guarantee of returns, but some pension companies can guarantee the deposited funds and state support. You can choose your own investment strategy.

Example: You have been saving 1,000 CZK (€40) per month for 10 years, and including the state support, you have saved 150,000 CZK (€6,000). You are 35 years old and will save until you are 65. Considering the specific returns of pension funds over the last 10 years and assuming the same in the future, you will have saved in total:

-

In the largest pension fund in the “old” scheme, with a return of 1.20% p.a. = 1,099,310 CZK (€43,972.40)

-

In the “new” scheme, dynamic fund KB, with a return of 3.70% p.a. = 1,801,066 CZK (€72,042.64)

-

In the “new” scheme, another dynamic fund, with a return of 6.60% p.a. = 3,394,144 CZK (€135,765.76)

Yes, there really is a difference of 2,294,834 CZK (€91,793.36) with a monthly contribution of 1,700 CZK (€68) – on the same financial product, just with a different setup!

Tax relief increases from 1 January 2024

For completeness, let’s add the changes that have been valid since 1 January 2024:

A tax deduction can be claimed on contributions that exceed the amount required for the maximum state contribution. Until 30 June 2024, this will be deposits over 1,000 CZK (€40). From 1 July 2024, it will be deposits over 1,700 CZK (€68).

You can deduct contributions from your taxable income up to a total of 48,000 CZK (€1,920) (shared with other products). At a tax rate of 15%, the maximum annual tax saving is 7,200 CZK (€288).

This means that you will achieve the maximum benefits of your pension product (highest state contribution and tax relief) under the new conditions with a monthly contribution of 5,700 CZK (€228).

When preparing for retirement, it’s worth considering how much to allocate to pension savings and how much to direct to a Long-Term Investment Product, which we wrote about in this article.

Clearly, setting up the contract correctly is not simple – but with your advisor, you will definitely find the right option.

Note: Fixed rate used: 1 EUR = 25 CZK.

Stone & belter blog

Similar articles

Category