Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

Loans from Building Savings

Mortgage or building savings loan. Isn’t it the same?

You can arrange a housing loan at a bank as a traditional mortgage or as a loan from building savings. Building societies provide two basic types of loans: the regular loan and the bridging loan. Both can be secured by real estate or unsecured.

A regular loan is granted to a client who has saved 20%, 35%, or 40% of the target loan amount in their building savings account. The building society then lends them the rest.

Already when signing the building savings contract, you know what interest rate you’ll get on deposits and also what the interest rate on a potential loan will be. The advantage of a loan from building savings is exactly that—you know the interest rate, and it remains fixed for the entire repayment period of the regular loan. The regular loan is repaid annuity-style: each month you pay interest plus a portion of the principal.

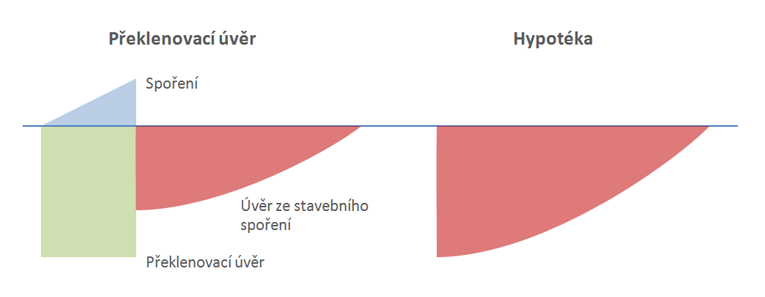

It’s different, however, if you don’t meet the conditions for being granted a regular loan—if you haven’t saved enough, the building society provides you with a bridging loan.

With a bridging loan, the building society provides you with the full required amount, regardless of your saved funds. You pay interest on the full amount while continuing to save into your building savings account. Your loan contract therefore specifies three payments: the monthly interest installment, the savings deposit, and the repayment installment of the regular loan (once you qualify for it).

Once you have saved enough—40% of the target amount—the bridging loan converts into a regular loan. From that point, you pay a single annuity installment covering both interest and principal—that third amount mentioned in the loan contract.

In simplified terms: for about 60% of the time, you pay interest on the full amount while saving. For the remaining 40% of the time, you must repay 60% of the loan.

(Source: www.stavebky.cz)

When should you use a loan from building savings?

Take a look at the interest rate on your contract—it might surprise you. For example, years ago when terminating an old contract, you may have wanted a quick payout and your advisor arranged a follow-up contract for free. Such contracts can include a guaranteed loan rate of just 2.99%. In today’s environment of high mortgage rates, that’s a small treasure!

By signing a building savings contract, you lock in guaranteed interest rates both on deposits and on loans for the entire duration of the contract/loan.

Annuity-repaid unsecured loans for renovations

Building societies now offer unsecured loans where the bridging phase lasts only two years (to meet the legal requirement) before switching to annuity repayment. Compared to consumer loans, you can get repayment terms of up to 25 years—even without collateral. Maybe your cottage needs a new roof?

Building savings loan for purchasing cooperative housing

Building societies are also well-suited for financing the purchase of a cooperative share, where it’s not possible to convert the apartment into private ownership and thus use it as collateral for a mortgage.

-

Raiffeisen Building Society provides up to CZK 2,000,000 (≈ EUR 80,000) for purchasing cooperative housing, with annuity repayment up to 25 years and until the borrower is 72 years old.

-

Buřinka (ČS Building Society) offers up to CZK 3,500,000 (≈ EUR 140,000), with repayment possible almost up to age 75.

Possibility of repayment up to 75 years of age?

ČS Building Society allows unsecured loan repayment until 74 years and 11 months of age. Whether such a solution is suitable for you should be discussed with your financial advisor.

Loans for housing needs of close relatives

A building society allows you to arrange a loan to finance your children’s housing, or conversely, the renovation of your parents’ apartment.

Consolidation of consumer loans used for housing or furnishing

This is a great example of how to ease your installment burden if you financed home furnishings or part of a renovation (that ended up more expensive than expected) with a consumer loan or credit card. With some building societies, you don’t even need to present receipts—just a sworn statement is enough.

Building savings loan for photovoltaic systems and heat pumps

Eco-program or Loan for the Future—special tariffs offered by building societies designed for financing solar panels or heat pumps. A government subsidy shortens your repayment period.

If you use an older contract with a low interest rate, the subsidy can shorten the bridging period and get you to the regular loan phase faster! So, a special tariff isn’t always the better choice.

Conclusion

Building savings loans are no longer just a tool to renovate your bathroom. Their use is broad, and a good advisor will prepare an analysis of whether, in your specific case, a building savings loan might be a better option than a mortgage. The interest rate is not the only parameter to consider when making your decision.

High mortgage rates once again make building savings loans an attractive option. Whether it’s the right choice for you is something your financial advisor can tell you.

(We’ve already written in a previous article about the suitability of building savings for your children.)

Note: All conversions from CZK to EUR in this article were calculated using a fixed rate of 25 CZK = 1 EUR.

Stone & belter blog

Similar articles

Category