Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

Savings Account vs. Inflation: How to Protect Your Savings

Savings accounts are often the first choice for many people who want to keep their money safe. But the question is: Can these accounts effectively protect our savings from inflation?

What is a savings account?

A savings account is a bank account that allows clients to deposit money and earn interest. These accounts usually offer a higher interest rate than regular accounts but lower than investment instruments.

What is inflation?

Inflation is an economic phenomenon where the prices of goods and services in the economy rise, reducing the purchasing power of money. If inflation exceeds the interest rates of savings accounts, your savings are actually losing value. In the last five years, average inflation was 7.12% per year.

How does inflation affect savings accounts?

If you have money in a savings account, it’s important to consider both its interest rate and the inflation rate. For example, if your savings account offers 3% and inflation is 5%, then in real terms your savings decrease by 2% per year. Simply put, if you have 100,000 CZK (€4,000) in a savings account, after one year its purchasing power will be worth 98,000 CZK (€3,920).

How to defend against inflation?

-

Investing: Instead of keeping all your money in a savings account, consider investments. Stocks, real estate, and other investment tools can have the potential to yield higher returns than savings account interest.

-

Diversification: Spreading investment funds across different asset classes can help protect your savings from inflation.

-

Term deposits with higher interest rates: With the help of your advisor, you can find more competitive interest rates.

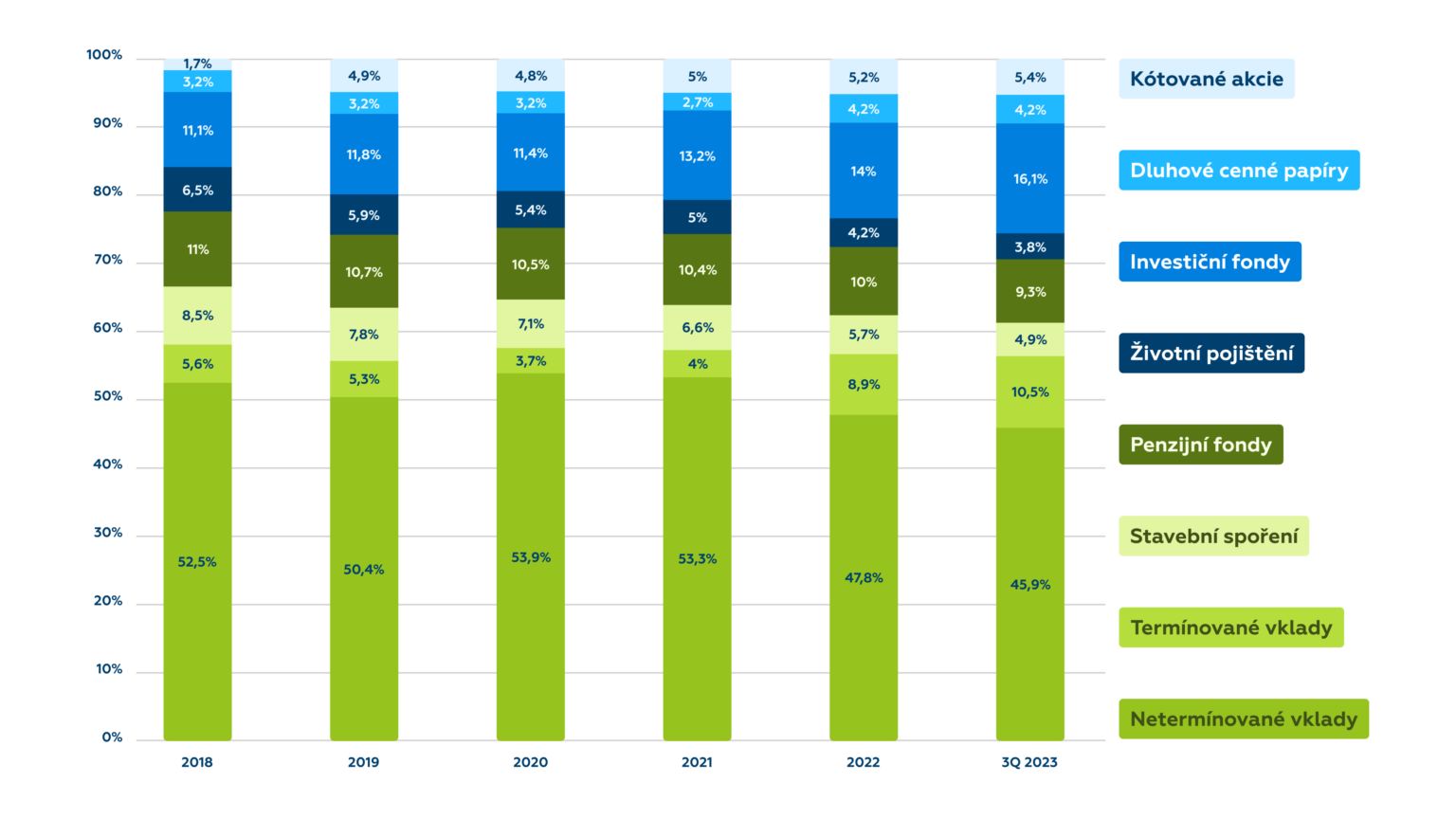

Household savings structure in the Czech Republic

(Source: Annual Press Conference of AKAT – March 12, 2024, and Financial Market Development Report 2023)

Here are hard data about the savings of all of us, citizens of the Czech Republic:

-

Current and savings accounts, together with term products, contain €156.8 billion (CZK 3.92 trillion).

-

Investments in collective investment funds total €44 billion (CZK 1.1 trillion).

Unfortunately, it turns out that the vast majority of money is stored in a way that has virtually no chance of beating inflation – and that’s a problem. I call it a problem because the basic premise of saving money is that it doesn’t lose value before our eyes.

Another issue is the fees and their structure in some sectors (life insurance, pension funds). Do you fall into this category of savers? Do you need the comfort of having a savings account reserve larger than six times your monthly expenses (usually 150,000 CZK - 300,000 CZK [€6,000 – €12,000])? Do you realize how much that comfort costs you?

Conclusion

Savings accounts seem to be a safe way to store your money at first glance, but when you look closer at inflation (usually about 1–2% above savings account rates), they prove inadequate and unsuitable for building long-term reserves. It’s important to adapt your financial management strategy to best protect the value of your savings. Moving money from a current account to a savings account is definitely not investing.

If you want to protect your money from inflation, consider other investment options and don’t be afraid to diversify your portfolio.

It’s high time to change your investment direction and consult your advisor about alternatives to savings accounts, such as bond, real estate, or equity funds.

It’s clear that proper investment allocation is not simple, but with your advisor, you’ll surely find the right option for you.

Note: Fixed rate used: 1 EUR = 25 CZK.

Stone & belter blog

Similar articles

Category