Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

The Magical Power of Paragraphs in Clients’ Investment Decision-Making I

When meeting with my clients, especially at the start of our cooperation, I often hear opinions that investments as a form of appreciating money are very dangerous, that they could lose their savings, that I guarantee them nothing – or worse – that I guarantee them a loss of real value if they keep their money safely in a bank. It’s often Sisyphean work, especially in recent years, when the market has been flooded with offers of “safe, profitable, CNB-approved, and state-guaranteed products,” mostly in the form of various corporate bonds. This belief is just as misguided as thinking that a mosquito will only suck subcutaneous fat from you.

Clients don’t know each other, yet this opinion is surprisingly widespread. That’s why I always ask what led them to this conclusion, where they heard or read it. The answer I usually get is simply “somewhere.” Just as farmhand Vincek had three nuts hit his nose – and thus a gift for Cinderella – I stumbled upon a survey by the company Moneco that answered my questions.

This survey was conducted at the University of Economics in Prague (VŠE) and the University of Finance and Administration (VŠFS). It examined the investment decision-making of 623 students from these universities and the effect of the (non)existence of legal regulation on their decisions for specific products. What did the survey find?

First, that the presence of legislative protection is a significant guide for investors’ decision-making. Even young and dynamic people, like the students surveyed, trust tools much more when there is at least some basic protective umbrella – or when they are presented that way. While this idea is somewhat inaccurate, it’s understandable from a human perspective – and not in itself that surprising.

What is truly shocking, however, is the second part of the survey.

It found that perceptions of the scope and real impact of legislative protection are often fatally mistaken – even among future economists and financiers like the respondents!

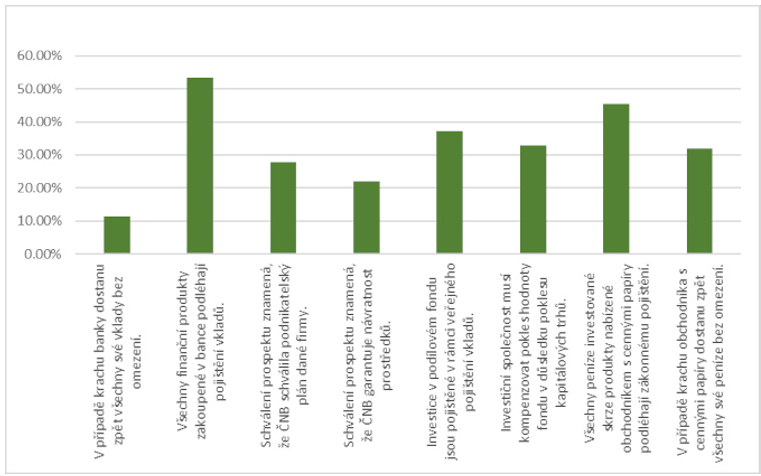

For example, almost 30% mistakenly believe that for corporate bonds – a very toxic area in recent years – the CNB, when approving a bond prospectus, also approves the company’s business plan. In reality, the CNB only checks the formal requirements of the issue.

Slightly over one-fifth of participants believe that granting a prospectus means the CNB guarantees the return (!) of funds invested in that bond.

Similarly, almost 40% of surveyed students believe that investments in mutual funds are insured under public deposit insurance. And almost one-third (!) assume that part of a fund manager’s job is to compensate for investment losses caused by declines in capital markets!

Looking at securities dealers – often used for individual trading – the results are equally troubling. Almost half of participants (wrongly) think that all investments made through them are insured under public insurance. And one-third believe there’s no insurance limit, so in the event of a broker’s bankruptcy, they would always get all their invested money back.

These results are summarised in detail in the chart below.

So much for the survey. If even future economists are this confused, how confused must “ordinary” people be? And why is this the case? I’m starting to understand where the wind is blowing from – and where exactly, you’ll find out in the second part.

If you want to experience adrenaline only during sports, on a roller coaster, or on a glass-floor lookout – and not when looking at your finances – write or call the contacts below. Over a good cup of coffee, we will gladly explain everything and together chase away any skeletons hiding in your financial closet.

Conversion note: This article contains no CZK amounts requiring conversion. Fixed rate used — 1 EUR = 25 CZK.

Stone & belter blog

Similar articles

Category