Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

Gold’s Role in an Investment Portfolio – Should You Buy When It’s at Historical Highs?

According to an April article in the Financial Times, the recent sharp rise in the price of gold is driven mainly by speculators and their speculative positions in Asia.

The claim is based on the volume of so-called futures contracts. According to the Financial Times, Chinese speculators on the Shanghai Stock Exchange are particularly active, increasing the number of futures contracts since September 2023 to 300,000 contracts on this exchange, which corresponds to a volume of over 300 tonnes of gold (approx. USD 25 billion). One company even “accumulated” 50 tonnes of gold in contracts. Some analysts jokingly note that “the Chinese have stopped speculating on real estate and have turned to precious metals.”

We discussed futures contracts in another article: https://stoneandbelter.cz/komodity-jako-soucast-investicniho-portfolia/

We don’t engage in speculation with clients, but rather in investments. So let’s look at what a strategic allocation of gold in a portfolio should be – and whether it belongs there at all.

Gold is at historical highs – are there more reasons to buy or to sell?

Gold doesn’t do anything! It is essentially just a rare metal whose value fluctuates depending on supply and demand. It generates no ongoing income, unlike other asset classes – shares often yield dividends, bonds pay regular coupons, and rental properties bring rent. Legendary investor Warren Buffett did not become a billionaire by investing in gold; he even calls gold an unproductive asset.

It can be said that gold is merely an outdated store of value, once used as a medium of exchange in trade, but apart from its use in jewellery and industry, it has no intrinsic value.

Commonly cited disadvantages of investing in gold:

-

Gold is an unproductive asset with no ongoing yield.

-

It has no intrinsic value. The price is determined by market supply and demand, with central banks being the main buyers in recent weeks. Among the biggest buyers of gold in recent years are countries with authoritarian regimes, such as Russia, India, or Turkey. By far the largest investor in gold last year was China, with 225 tonnes purchased.

-

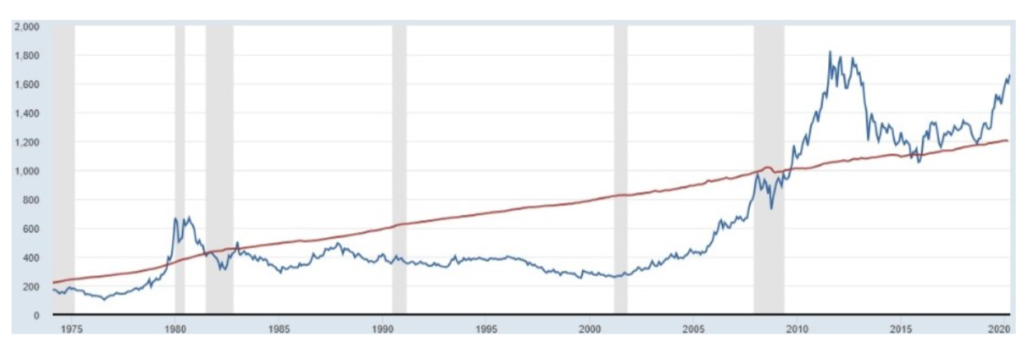

Gold is merely a store of value, not a value creator. For example, an investor who bought gold in 1980 would have waited over 25 years for its price to return to the original value.

-

Physical gold purchases involve fees. Buying larger amounts of gold bars or ingots also requires storage, for example, in a bank vault.

Does gold have a place in a portfolio?

Despite the above negatives, gold can have a place in a diversified investment portfolio, thanks to its unique market role. Some gold sellers claim its weight should be up to 20% of the portfolio value, depending on the investor’s risk tolerance. However, we side with the general consensus among wealth management professionals, which defines gold’s share as up to 5% of the portfolio.

Data supports the view that gold is not as conservative an investment as it is often portrayed. Compared to shares, gold is actually more volatile and less profitable. Looking at the frequency of negative 10-year returns:

-

Shares had negative returns over 10-year periods in only 3% of cases (positive in 97%).

-

Gold had negative returns over 10-year periods in 28% of cases.

If a client sees a 10-year loss risk as unacceptable, gold is the riskier investment – and shares clearly win, even today.

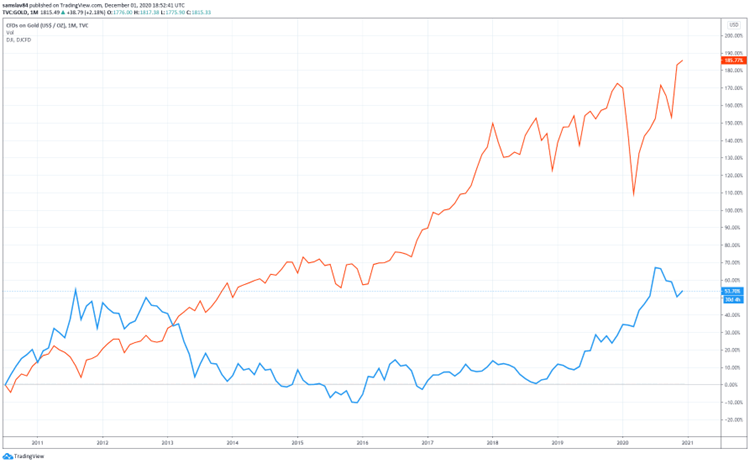

Gold vs. Shares – Dow Jones from 2011–2021

It’s logical that gold’s price has risen in recent years, given its role as an asset against inflation (very high in the last two years) and geopolitical situations like the war in Ukraine and tensions between China and the USA. Inflation is now falling, wars will sooner or later calm down (trade is always better than conflict), and what happens to gold’s price then – will it drop? No one knows.

A historical chart shows that from 1981 to 2000, the real value of gold compared to the real value of money fell by 150%. From 1975 to 2020, the last decade looks slightly more positive for gold.

Finally, let’s remember that gold mining requires significant effort and human resources, along with substantial environmental impact – an important factor in the era of ESG.

So, how should you approach gold in your portfolio?

If you don’t yet have gold, think carefully before buying when it’s at historical highs – and in what form. We can compare which form of purchase is most advantageous and what weight gold should have in your case.

If you already hold gold, consider its share in your portfolio and possibly move excess holdings into other assets that may generate higher returns in the coming years.

Stone & belter blog

Similar articles

Category