Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

Financing Options for Solar Panels and Heat Pumps You May Not Know About

Did you know there are several different loan types you can use to finance a heat pump or solar panels? With rising energy prices and the push for energy independence, more and more homeowners are considering these technologies. Not only can they reduce monthly bills for heating, hot water, and electricity, but they also provide long-term energy self-sufficiency.

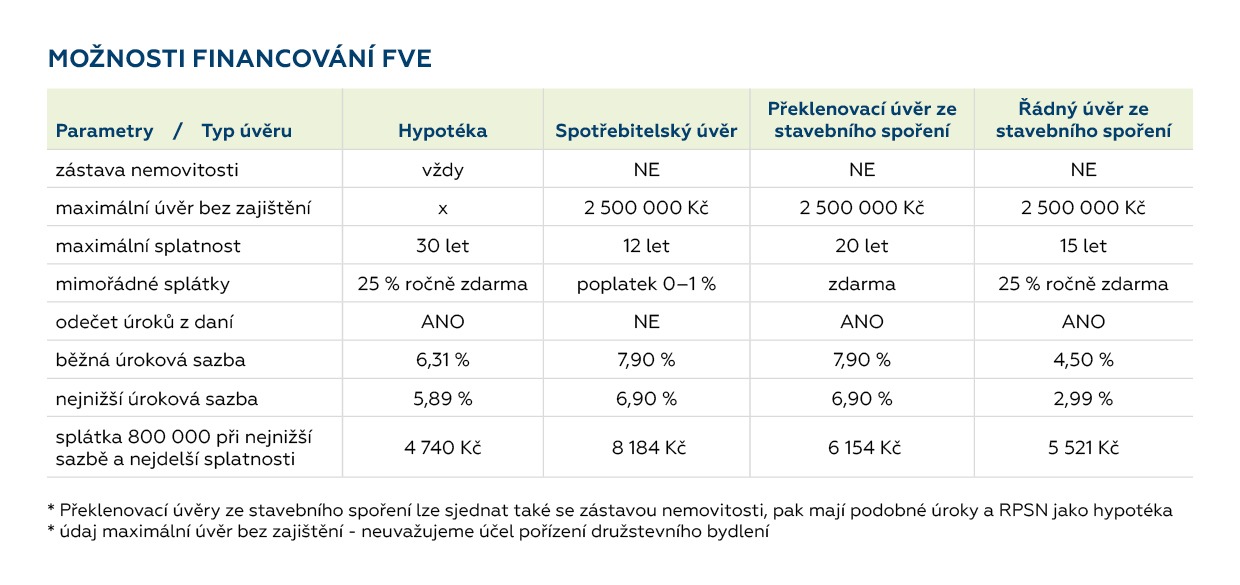

So which financing option is best – a mortgage, a consumer loan, or a loan from building savings?

The Most Common Loan Options

-

Mortgage Loan

-

✔️ Lowest interest rate and long repayment period.

-

❌ Requires pledging your home as collateral.

-

Best if you want the lowest monthly payment and don’t mind using your property as security.

-

-

Consumer Loan (Unsecured Personal Loan)

-

✔️ No collateral required, fast approval.

-

❌ Higher interest rate and shorter repayment term.

-

Suitable for smaller projects or if you don’t want to risk your home.

-

-

Bridge Loan from Building Savings (Překlenovací úvěr)

-

✔️ Allows you to borrow even if you don’t have enough savings accumulated.

-

❌ Often higher initial payments until the saving phase is completed.

-

-

Loan from Building Savings (Úvěr ze stavebního spoření)

-

✔️ Favorable conditions if you already have a contract with sufficient savings.

-

❌ Limited by the amount saved and by specific rules of the building savings scheme.

-

Key Factors to Consider

When choosing between these options, think about:

-

Collateral – Are you willing to pledge your property?

-

Maximum loan amount without collateral – Banks often have different limits.

-

Repayment flexibility – Can you make extra payments once you receive the state subsidy (Nová zelená úsporám)?

-

Total loan term – Longer repayment = lower monthly payments, but higher total interest.

Smart Questions to Ask Before Applying

-

Will I have funds available to repay early if I want to?

-

Can I provide invoices for materials and construction work?

-

How much will the project really cost, and do I have a buffer for unexpected expenses?

-

How will I cover potential additional costs?

-

Do I have protection against unforeseen risks such as job loss, illness, or reduced business income?

Summary

-

Mortgage loan → lowest monthly payment, but requires collateral.

-

Consumer loan → faster and easier, but more expensive.

-

Building savings loans → useful if you already have a contract or want to avoid a mortgage.

Choosing the right financing method depends on your financial situation, risk tolerance, and whether you want flexibility for early repayment once subsidies arrive.

👉 A financial advisor can help compare real offers from banks and savings institutions and find the option that best fits your budget and goals.

Stone & belter blog

Similar articles

Category