Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

Entrepreneurs and Company Income – Why It’s Good to Withdraw Profits from the Company

In this article, I will address the issue of owners of successful companies whose businesses have long shown positive financial results. Why is it important to gradually withdraw retained earnings from the company and thus build the financial independence of your “personal ID number”?

How Do Company Owners Properly Protect Their Assets?

Gradually withdrawing retained earnings and investing them in assets held personally is a strategy company owners use to build independence from their own business. This approach creates additional pillars of wealth from which they can draw income in the future, even in situations where, for various reasons, it would not be possible to do so from their own company. The most serious reason could be a poor economic situation or outright bankruptcy. In an extreme case, a company owner could lose everything.

The goal of investing funds withdrawn from the company is not primarily high returns but protection from risks through thorough diversification. The main aim is asset protection, with gradual growth as a secondary goal – without the need to aim for high double-digit returns, as such yields logically come with higher risk. High returns and high risk are already embedded in the business itself. Funds invested personally serve as a more conservative part of the overall portfolio.

The Czech Investment Reality

For entrepreneurs in Western Europe and the USA, the key is to structure wealth in such a way that it grows steadily over many generations. They think in infinite time horizons, allowing them to avoid overreacting to short-term changes in economic conditions and making hasty changes to asset structures. They also think globally, diversifying their portfolios across currencies, geographies, asset types, and industries. They know how each part of their wealth will behave during economic booms, recessions, or crises. Their main goal is to preserve and protect family wealth from unnecessary risks while gradually expanding it to pass on to future generations.

In our country, unfortunately, this is often not the case. Czech entrepreneurs and investors make a fundamental mistake without realizing it – they invest too much in the Czech Republic and the Central European region. Because they own businesses here, they tend to also buy additional investment properties and other assets in the same region. They follow the seemingly logical thought of investing in what they understand and what is geographically close, which on the surface makes sense. Unfortunately, this exposes them to significant risks related to the given region, its currency, and often its industry. If the region experiences an economic downturn, they are likely to feel it strongly.

Even with a certain level of insight and “good advice” from their private bankers, portfolios are often put together haphazardly, sometimes completely out of sync with the overall structure. This can include various investment certificates, shares of currently “trendy” companies, or assorted corporate bonds.

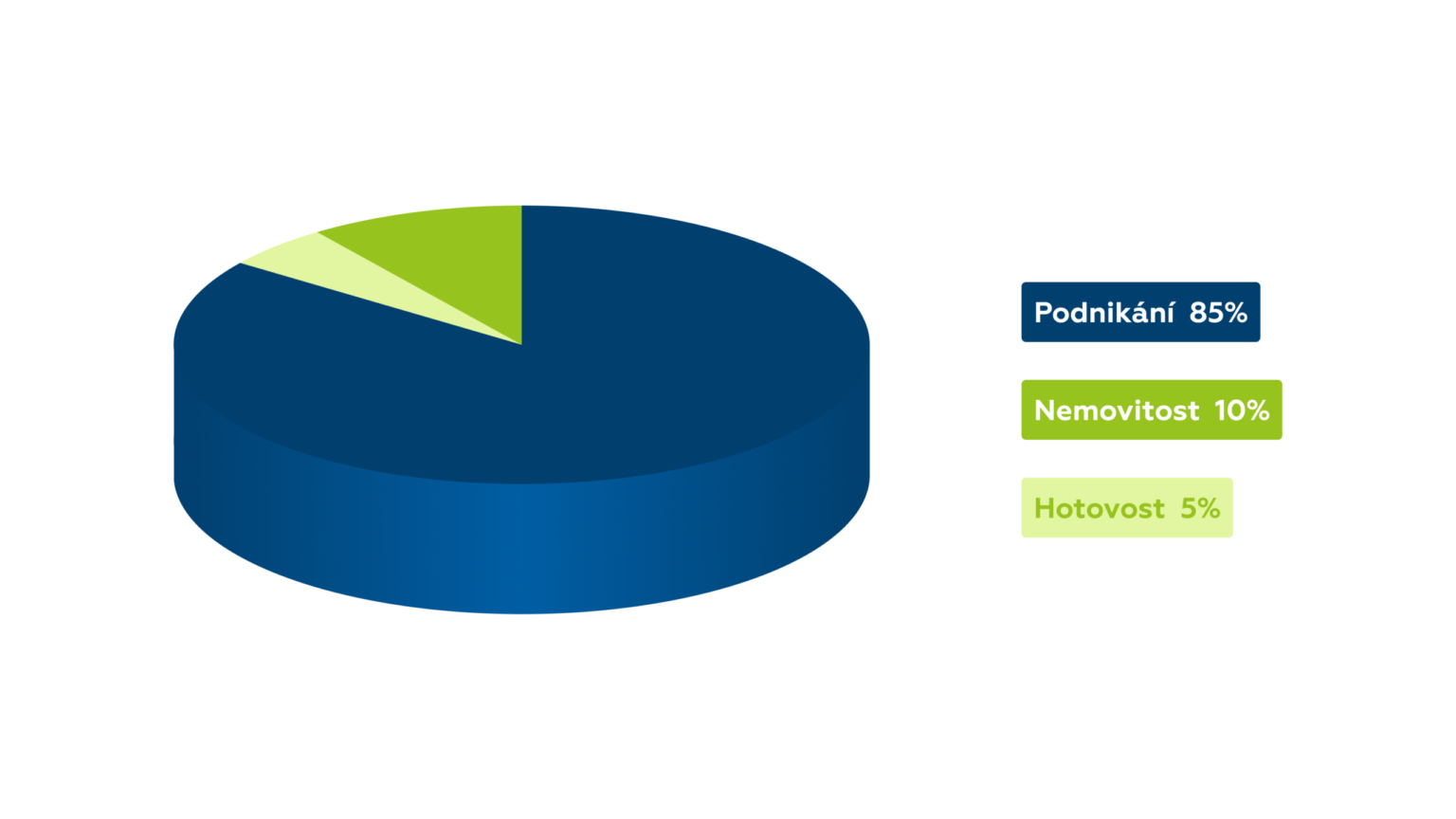

In practice, the vast majority of entrepreneurs have their wealth concentrated in one way – about 85% of their total assets are tied up in their business. The more thoughtful ones are able to take money out of the company and buy real estate personally or keep cash for ad-hoc investments. But as you can see, this often lacks any meaningful diversification.

Source: SUŠÁNKA, Jan. How dollar millionaires invest Online.

The Security of Three Pillars

In Western countries, entrepreneurs follow the “three pillars” rule – three key areas of asset allocation, which can be supplemented by a speculative component, cash, art, or cryptocurrencies, usually making up 5–10% of the portfolio.

The first pillar is the business itself – the owner’s company. It typically delivers high returns but also comes with high risk. Given their knowledge of their own business, entrepreneurs might think it logical to invest primarily here. In the Czech Republic, however, business owners often bet heavily on the idea that their business will always do well. The prospect of high profits leads them to overweight this pillar significantly. A common mistake is allowing retained earnings to sit idle in the company for years simply to avoid paying additional tax.

The second pillar is real estate, which plays a diversifying role and provides stable income. This may be owned via funds or, as is popular in our country, in physical form – “bricks and mortar.”

The third pillar is a globally diversified portfolio – financial assets systematically structured in a global environment and in foreign currencies, which is desirable from a diversification perspective.

As noted above, these three pillars don’t add up to 100%, because it is also advisable to have an alternative component (cash, cryptocurrencies, art, precious metals, etc.). This correct structure provides the foundation from which a business owner can operate. If one pillar experiences a downturn, the other two remain, significantly reducing the total realized loss. The additional component can serve as a “spice” or stabilizer for the portfolio.

Source: SUŠÁNKA, Jan. Working whit family assets of entrepreneurs from the 1990s. Online.

Conclusion

It’s wrong to assume that if business is good today, it will remain that way for decades to come. The allure of double-digit returns and the reluctance to pay an additional 15% tax on distributed profits is a strong motivation to leave retained earnings in the company. But where there is high return, there is also high risk – betting everything on “one card” is investment gambling.

If funds are left idle in a company account, they don’t increase returns but only increase risk – perhaps the worst option of all. Unfortunately, many Czech entrepreneurs like to “sit” on retained earnings. As noted above, withdrawing profits from a company may seem unattractive at first glance. The opposite is true – in long-term wealth building, diversification and building personal independence from one’s business are essential. If the company fails, two pillars remain, greatly reducing the overall loss.

That’s why it’s crucial to emphasize this fact to clients. For those with assets already in the millions or tens of millions, the key role is protecting wealth rather than chasing returns – even at the cost of paying tax on profits or accepting single-digit returns. An entrepreneur who hears only “return” and ignores “risk” is simply not ready to be our client.

Stone & belter blog

Similar articles

Category