Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

DIP: Long-Term Investment Product – An Investment Opportunity with Tax Benefits

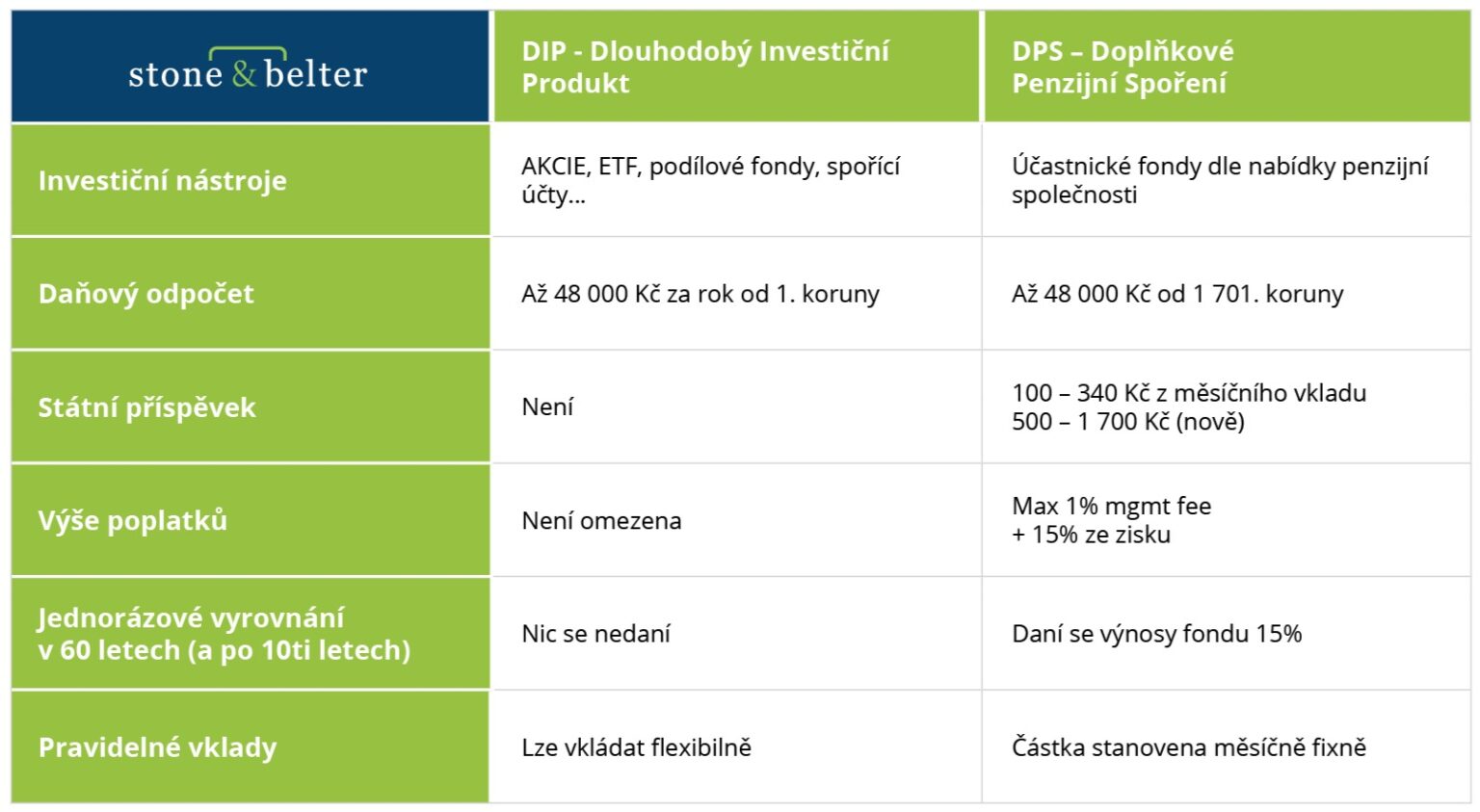

A DIP is not a new investment product, but a way to gain tax benefits with existing investment instruments. Newly, it is possible to invest with tax advantages even outside pension funds and life insurance products – in mutual funds (equity, bond, real estate), ETFs, or money market instruments. Unlike Pension Savings, with which it will most often be compared, you can have multiple DIP contracts with one or more providers.

Basic parameters and advantages of the DIP

-

Tax advantage: Employees and self-employed persons can deduct up to 48,000 CZK (€1,920) per year from the tax base (i.e., up to 4,000 CZK (€160) per month). At a 15% tax rate, the income tax saving is 7,200 CZK (€288).

-

Employer contribution: Can be up to 50,000 CZK (€2,000) per year; exempt from social and health insurance contributions and personal income tax.

-

The “120 months/60 years” rule: Invest for at least 120 months (10 years) and withdraw funds no earlier than at age 60. The duration is 10 years regardless of the number of active saving months.

Possible pitfalls of the DIP

Unlike pension companies, where investments are managed by the pension company, with a DIP you can set the strategy yourself. This flexibility, however, brings the risk of errors and inappropriate choice of product and investment strategy (too conservative, too dynamic).

Beware of online solutions, where an inappropriate evaluation of your investment profile can result in unsuitable proposals (see point above).

Fees – Unlike DPS, DIP fees are not regulated. High entry fees can affect returns. It is also important to monitor costs – so-called management fees.

Political risk: As with “building savings” or “pension savings,” state contributions and tax benefits can change over time, and within a DIP the amount of tax benefits could be adjusted in the future. However, the funds always remain yours.

Contracts usually do not include designated beneficiaries as with pension savings or life insurance.

Strategies for different age groups

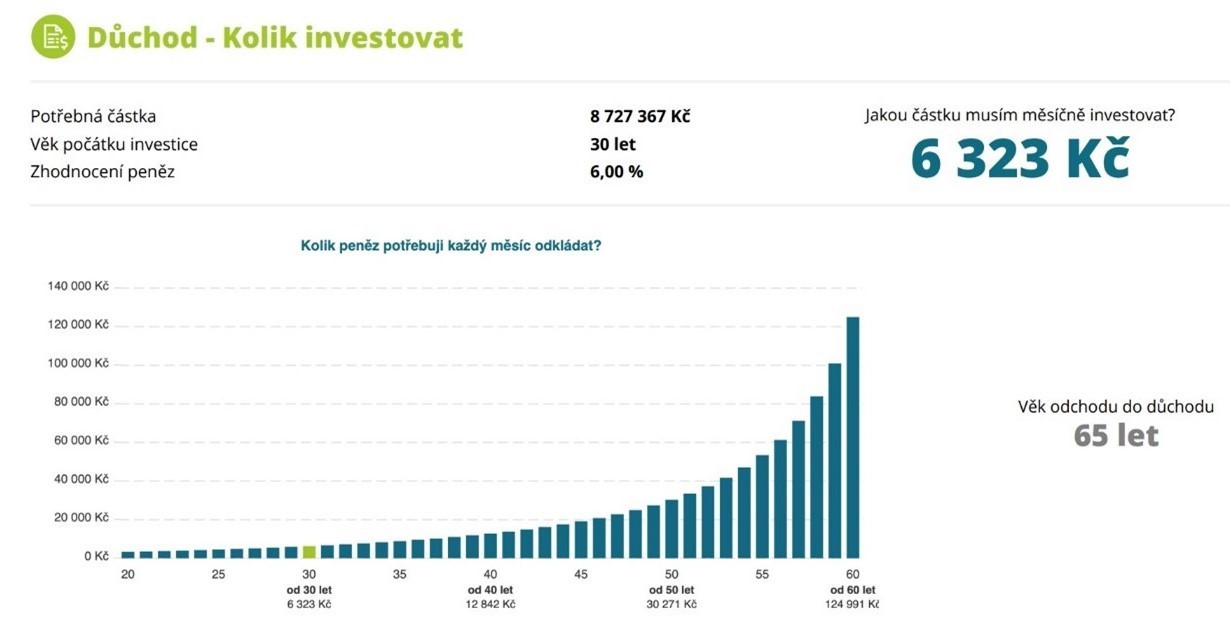

A DIP is not a universal solution but can serve as an effective addition to your financial portfolio. The basis is to carefully set your goals and create an investment plan that reflects your individual needs. Effective use of a DIP depends on the investor’s age. The earlier you start investing, the more time you will have to significantly increase your funds. Examples of monthly contributions at different ages show how time can affect the final amount.

Imagine you want to have a retirement income of 50,000 CZK (€2,000) per month for 20 years. This means you need about 8,700,000 CZK (€348,000). The funds can be composed of DPS, DIP, and other investments. Depending on the age at which you start investing/saving, you will need to set aside monthly at a 6% return:

-

At age 20: 3,312 CZK (€132.48) per month

-

At age 30: 6,323 CZK (€252.92) per month

-

At age 40: 12,842 CZK (€513.68) per month

-

At age 45: 19,154 CZK (€766.16) per month

General suggestion for most people seriously preparing for retirement (if you can set aside more than 2,000 CZK (€80) monthly for the long term):

-

1,000–1,700 CZK (€40–€68) into DPS (state contribution)

-

4,000 CZK (€160) monthly into DIP (maximum tax advantage)

A DIP can be set up with state-regulated institutions such as banks, investment companies, etc. You can check all companies directly on the CNB website; examples include: Amundi, Atris, Colosseum, Conseq, Cyrrus, Česká Spořitelna, ČSOB, Efekta, EnCor, Fondee, Generali Investments, Investika, Moneco, Patria, Raiffeisenbank, Wood & Co – Edward.

Investment restrictions within a DIP

You cannot invest in most corporate bonds that are not traded on a regulated market, or in risky instruments such as leveraged investment securities and bonds under section 15.

How will it be possible to withdraw the money?

An investor can start withdrawing money only after 120 months of saving and reaching the age of at least 60, if they do not want to lose the tax benefits retroactively. Exceptions exist for early withdrawals, for example in the case of third-degree disability or transferring funds to a new DIP provider.

Conclusion

A DIP offers a new perspective on long-term investing and has the advantage of providing tax benefits. However, it is important to carefully consider all risks, advantages, and disadvantages, and adapt them to the individual financial goals and situation of each investor. Anyone considering investing in a DIP should consult their plan with a financial advisor and explore the possibilities of this form of investment.

Conversion note: Fixed rate used — 1 EUR = 25 CZK.

Stone & belter blog

Similar articles

Category