Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

Building Savings or Regular Investment?

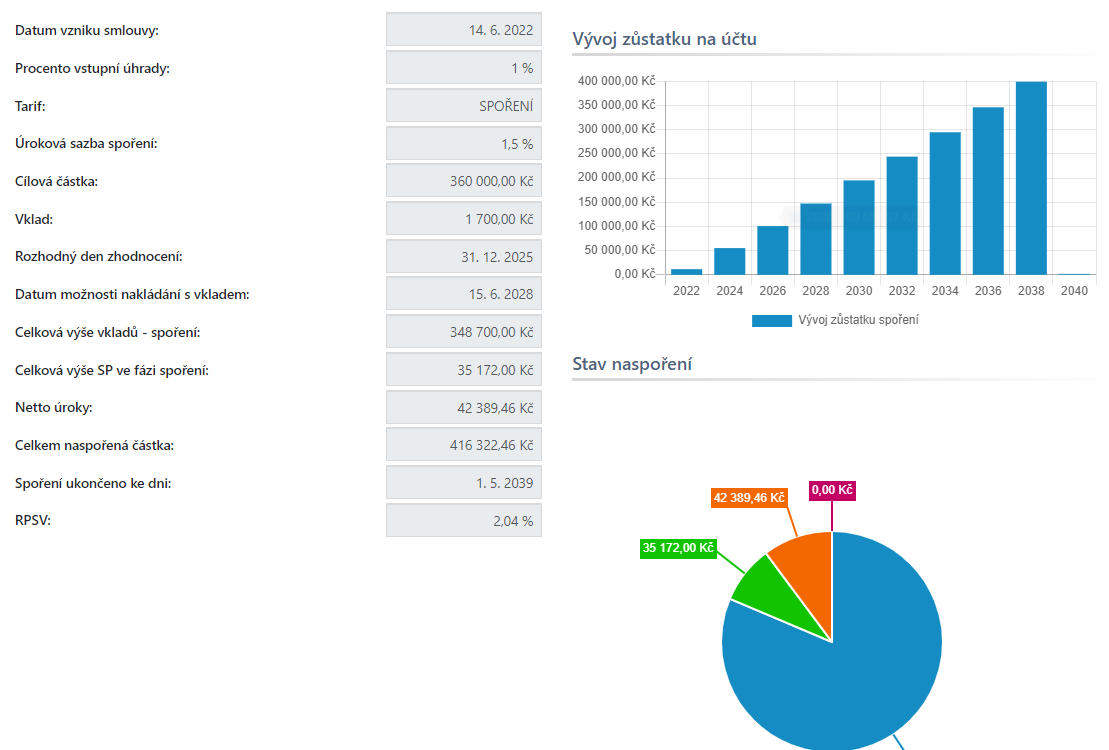

The state subsidy has a significant impact on the profitability of building savings. It increases returns by several percent. Currently, the political scene is discussing whether the state contribution will continue in the future.

Most often, we associate building savings with saving for children. So, let’s look at when building savings is and isn’t a suitable savings product for children. We will also examine several model situations where we might deprive our children or grandchildren of hundreds of thousands of CZK.

When meeting new clients, we always get to the current contracts they already have in the family. A common phrase is: “Well, of course, we have building savings for the children.”

“And why did you choose a building savings contract?”

“Well, Maruška (neighbor, building savings representative) advised us, she said it’s the best thing our children can have from birth.”

So today, children have CZK 140,000 (~€5,600) saved on a contract after six years, including state support. If the children are older than six, they often have a second or third contract. Then, money from the previous, closed contract is often sitting somewhere in a savings account.

And the option that’s better by hundreds of thousands?

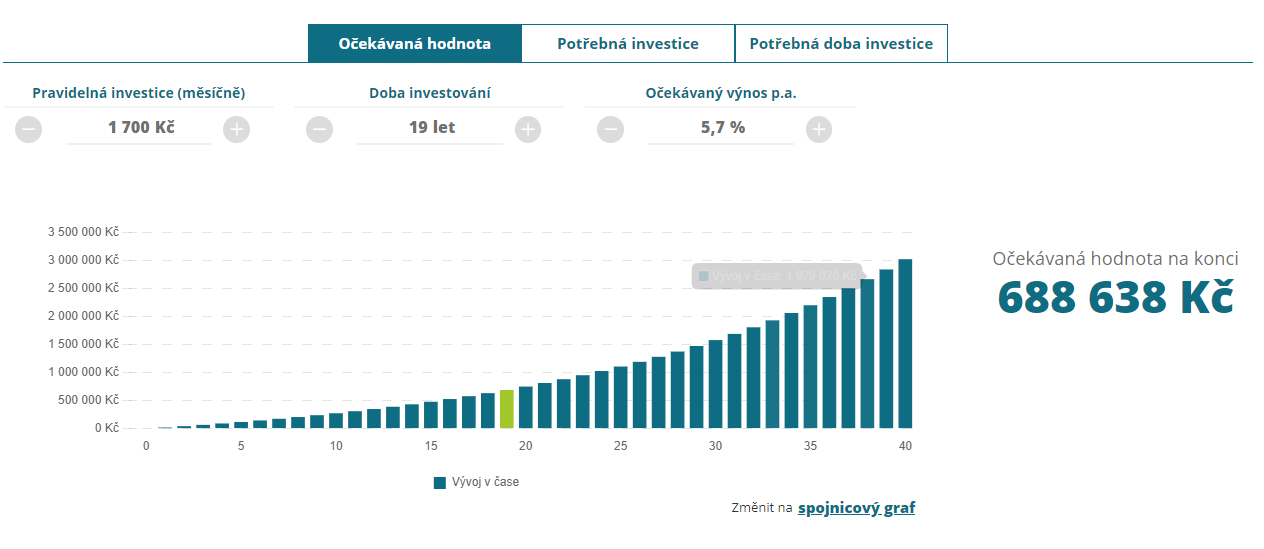

If you know you want to give money to your children only after high school, choose regular investment instead of building savings, for example in mutual funds.

For comparison, I selected the Amundi US Pioneer Fund in CZK, for which we have data since 2011. Over the past 10 years, the fund achieved an average annual return of 8.9% (after management fees).

With a monthly deposit of CZK 1,700 (~€68), a son or daughter could have CZK 327,000 (~€13,080) saved after six years. And after high school graduation (19 years of saving), a respectable CZK 1,006,000 (~€40,240).

Building savings is not a bad product—it just needs to be used correctly, according to its intended purpose. To save an amount that will be spent once for a specific purpose, for example, remodeling a child’s room for a future school-aged child. Building savings can also make sense when planning a loan.

However, if you just want to save money for “someday”, for a life start, or so that children one day have a down payment for an apartment, it is better to take a different path: regular investment into a carefully chosen investment portfolio.

Source: Graph 1: Simulation of building savings development RSTS according to the internal system. Graph 2: Stone & Belter simulation.

And how is it at your home? Building savings or regular investments?

We are happy to discuss with you what the right solution is for you personally. Next to this article, you can find my contact information—simply send an email, call, or click “Request an offer,” and after leaving your contact details, I will get in touch.

Note: All CZK amounts were converted to EUR using a fixed rate of 25 CZK = 1 EUR.

Stone & belter blog

Similar articles

Category