Blog: finance and real estate made simple

Articles and insights to help you navigate and grow

Are Bond Funds the Opportunity of This Decade from the Perspective of Return and Risk?

The situation in the fall of 2023 brings an interesting investment opportunity, shaped by interest rates and their future development.

The current trend is high interest rates on savings accounts, which are the highest in the last 20 years. The base interest rate of the Czech National Bank (CNB) in the Czech Republic stands at 7%. Thanks to this, commercial banks can offer savings account returns in the range of 3–5% p.a. Most banks, however, have set a maximum deposit amount that earns the higher percentage rate, and money above this limit in some cases does not earn interest at all. The prosperity of high interest rates on savings accounts will not last forever, and they will gradually decrease.

How can you secure above-standard returns in the coming years and protect your savings from inflation?

The answer may be bond funds. When interest rates rise, bond prices fall—and vice versa. At present, we are likely at the peak of the interest rate hike cycle.

Investing in quality bond funds can be an attractive conservative investment, providing you with above-standard returns and protection of your savings against inflation.

If you want more information on how to grow your savings in the coming years, do not hesitate to reach out.

2023 2024 2025

| Indicator | 2023 | 2024 | 2025 |

|---|---|---|---|

| Overall Inflation (%) | 11.0 | 2.1 | 1.7 |

| Monetary-Policy Inflation (%) | 10.9 | 2.1 | 1.6 |

| Gross Domestic Product (YoY % change) | 0.1 | 2.3 | 2.7 |

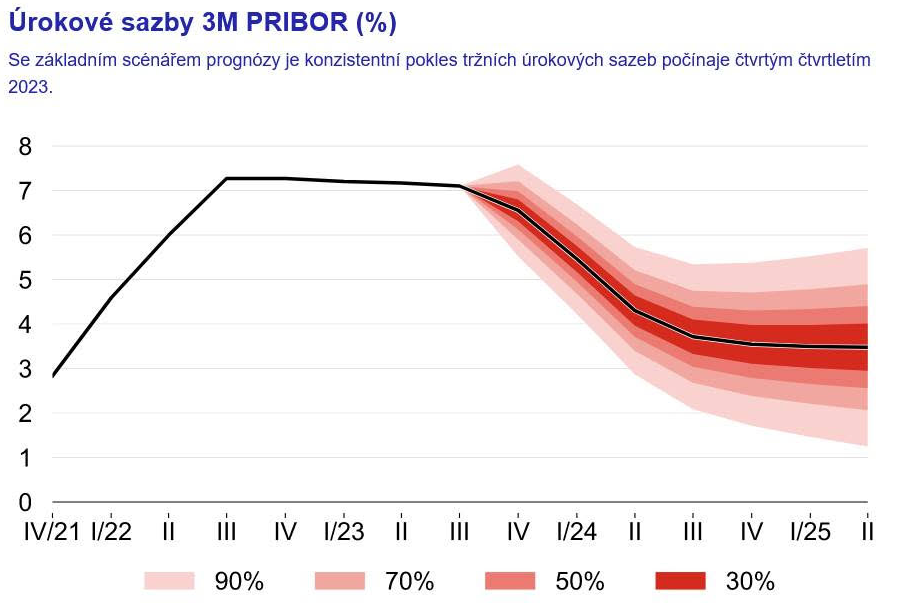

| Interest Rates 3M PRIBOR (%) | 6.9 | 4.8 | 3.7 |

| Exchange Rate (CZK/EUR) | 23.9 | 24.7 | 24.6 |

Source: Czech National Bank

Note: All amounts originally stated in CZK have been converted into EUR using a fixed exchange rate of 25 CZK = 1 EUR.

Stone & belter blog

Similar articles

Category