Credit Card and Overdraft: Who’s the Servant and Who’s the Bad Master

Credit Card and Overdraft: Who’s the Servant and Who’s the Bad Master

“Christmas is coming, friends, let’s sing together, once again Christmas is coming, merry and bright.”

It’s very easy to succumb to emotional shopping during the Christmas season – even financially savvy individuals can fall into the trap. But the step from a few emotional purchases that make us shed a tear when looking at our January bank statement, to the vicious circle of repayments, is shorter than many might think. After all, it’s so easy when the card just keeps giving…

When the card just keeps giving. The devil is in the details. Most Czechs carry a plastic card in their wallet that they call a credit card. Yet only about 20% of them actually have a real credit card.

What’s the difference between a debit/payment card and a credit card? The key difference lies in how you draw the money. With a debit card, you withdraw money directly from your bank account. You can spend only as much as you have in the bank – unless you’ve arranged an overdraft, which we’ll get to later. With a credit card, however, your account balance doesn’t matter because you have a credit account with the bank – a so-called revolving credit. Essentially, you’re shopping on credit, and you can spend far more than with a debit card. And you can even repay this debt interest-free!

You may be asking why banks would let clients borrow money for free. The answer is simple – many clients borrow amounts they cannot repay by the due date. Or banks count on clients forgetting to repay on time. That’s when a hefty interest charge comes into play, calculated from the purchase date. In my banking days, when I mentioned a credit card to clients, they often looked as if they had just swallowed fish oil! A credit card can be a good servant, but it can also be a bad master. So, it’s worth following a few key rules to make sure your credit card stays the good servant.

Interest-free period

At the end of the billing cycle (usually the end of the month), the bank sends you a statement saying you owe them money. Then comes a period of 15–25 days to repay it. If you fail to do so, the bank will charge interest for the entire period you used the money – not just from the statement date.

Example 1:

-

On December 1, you buy a TV for 10,000 CZK (€400) from a bank with a maximum 45-day interest-free period.

-

At the end of December, the bank sends you a statement showing you used the card to pay for the TV.

-

Within 15 days of receiving the statement – i.e., within 45 days of purchase – the money must be back in the bank’s account.

Example 2:

-

On December 15, you buy a mobile phone for 5,000CZK (€200).

-

At the end of December, the bank sends you a statement showing you used the card for the phone purchase.

-

Within 15 days of receiving the statement – i.e., within 31 days of purchase – the money must be repaid to the bank.

The interest-free period is longest when you shop the day after the statement is issued. Conversely, the closer you are to the end of the billing cycle, the sooner after purchase you’ll have to repay. And remember – if you miss repayment, you pay interest for the entire borrowing period, not just from the statement date. If unpaid, the card can quickly turn into an expensive “pleasure.”

Overdraft

The advantage of an overdraft, or authorized account overdraft, is its ease of use. You pay with the same card, even when your account is empty! It’s easy not to notice and just keep paying… Unlike a credit card’s interest-free period, you pay interest from the moment you go into overdraft. Paying for a motorway vignette from your overdraft three days before New Year’s Eve, when your paycheck arrives on January 5, is bearable. But repaying all Christmas expenses until March hurts a lot more. You stop paying interest only once your account returns to a positive balance.

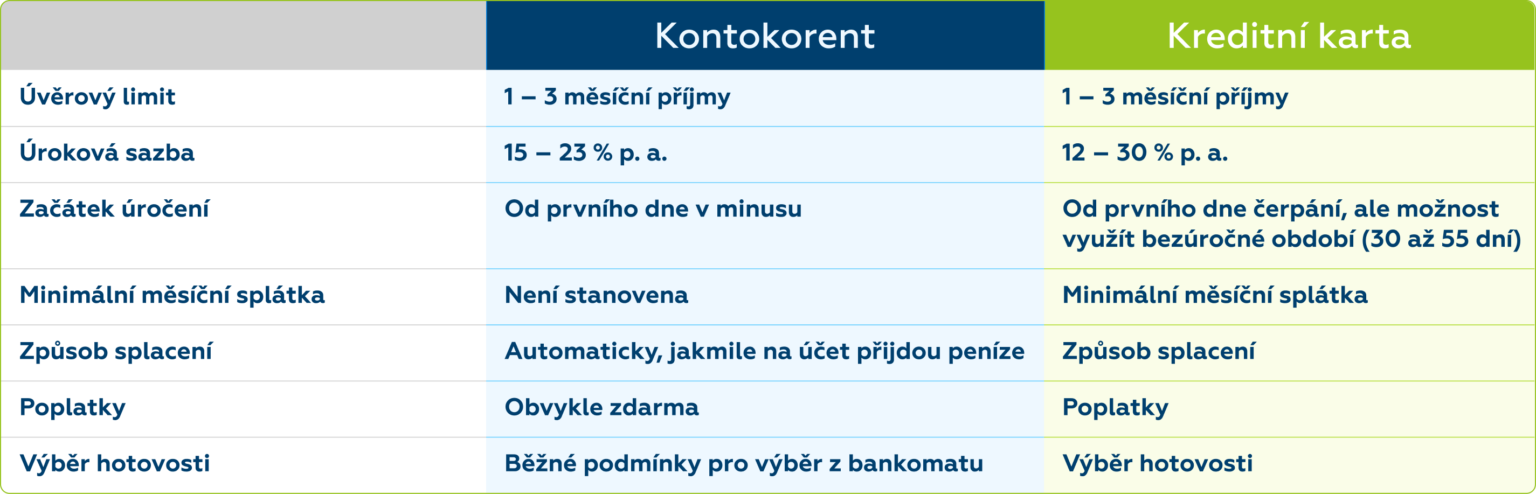

Comparing the advantages and disadvantages of overdraft and credit card

A debit card is most useful in the Czech Republic for everyday purchases. A credit card, however, is also worth using abroad – especially for payments in foreign currencies and outside the EU, where debit card acceptance may be problematic. It’s also useful for car rentals, online purchases where an amount is blocked on your account, etc. This way, your own money isn’t frozen.

A credit card works perfectly for those who have a good overview of their finances and use it responsibly. If you carefully watch repayment dates or set up 100% direct debit, the credit card becomes a loyal servant. Debit and credit cards compete for the gold medal, while overdraft still wears the laurel wreath for third place.

If you want to take advantage of all the benefits of debit and credit cards as well as other financial products, write or call us!

Note: Fixed rate used: 1 EUR = 25 CZK.

Stone & belter blog

Similar articles

Category